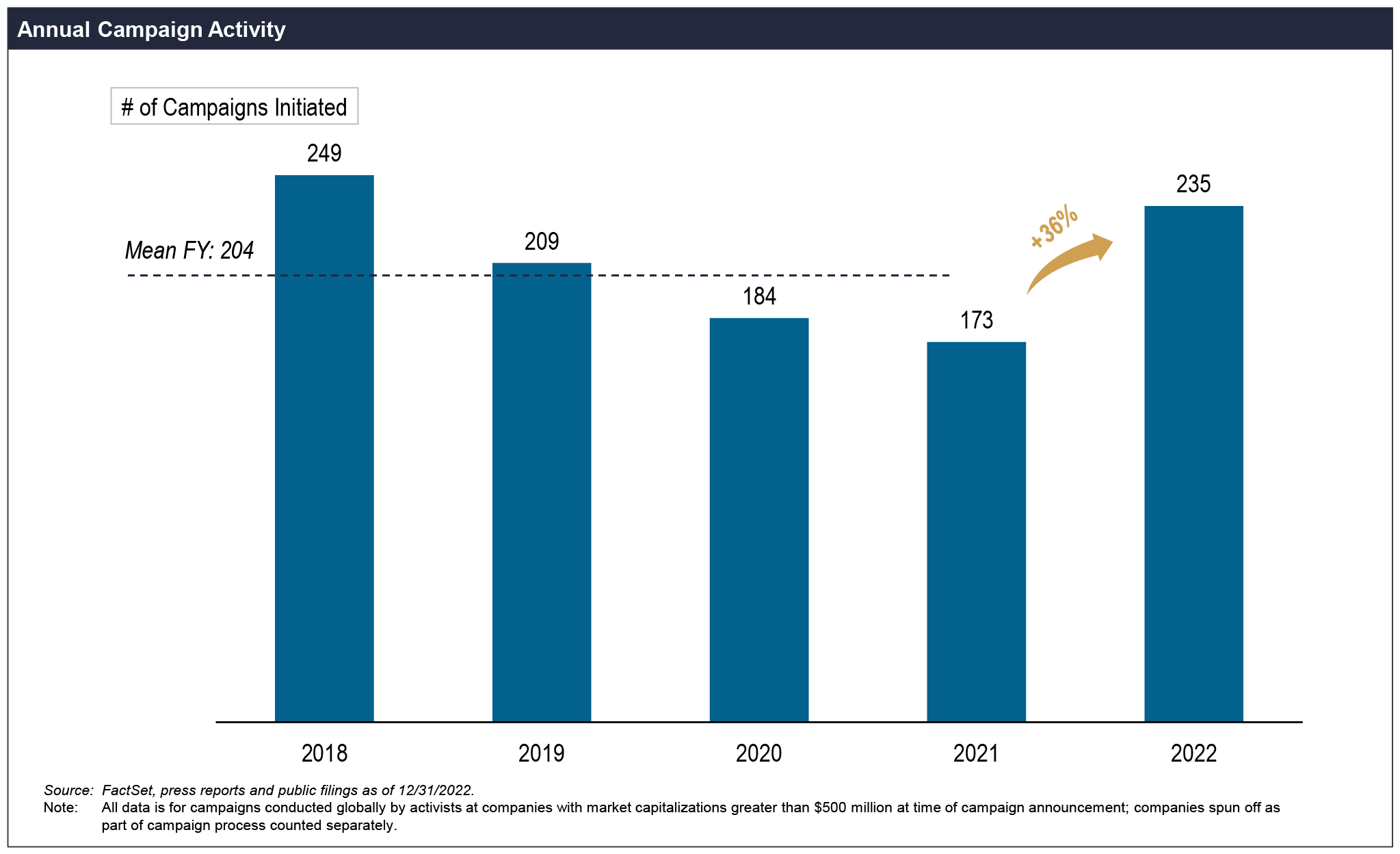

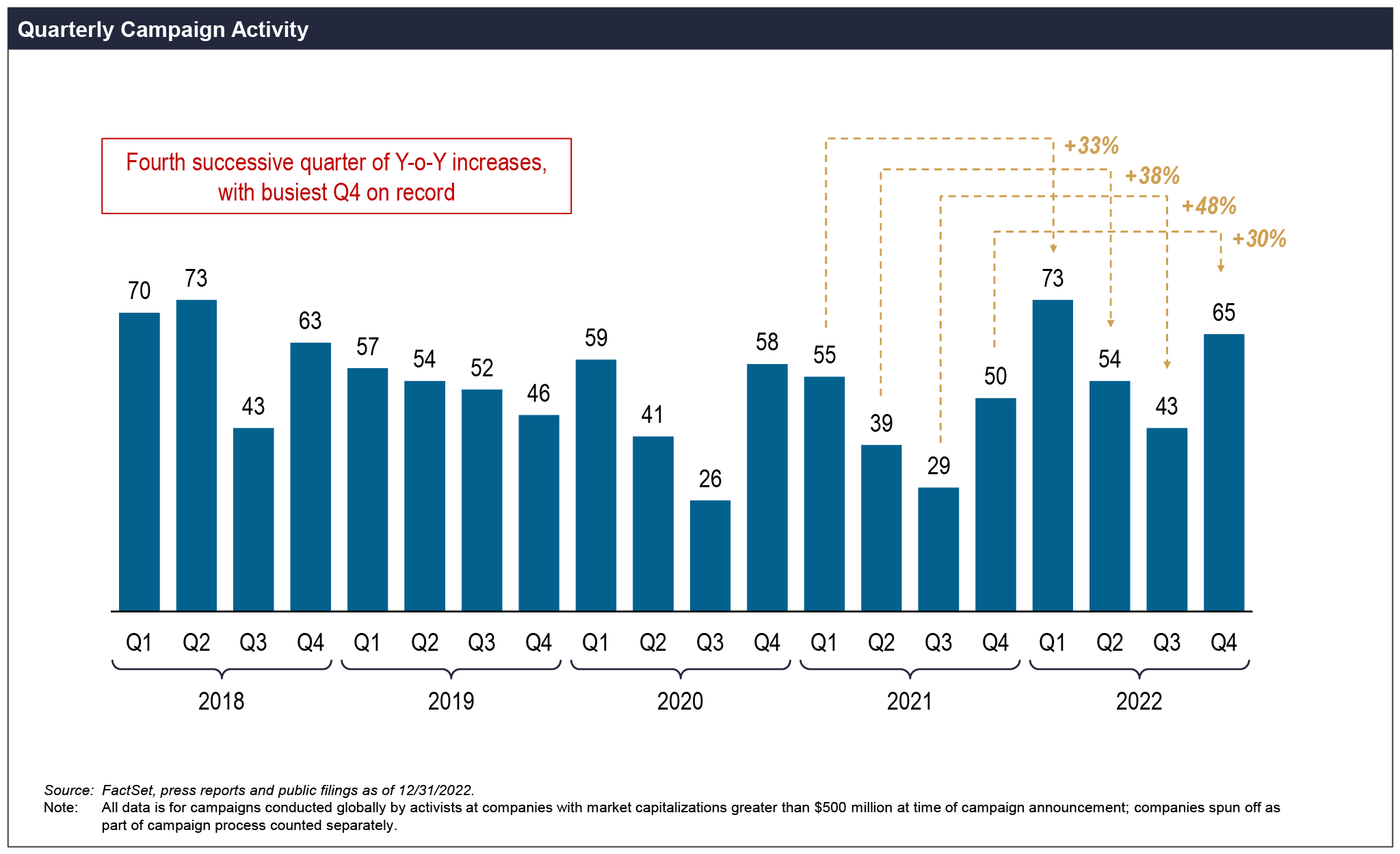

Each quarter in 2022 saw a material y/y increase in new campaign activity, with Q4 marking the second busiest single quarter in the last four years after a record-setting Q1.

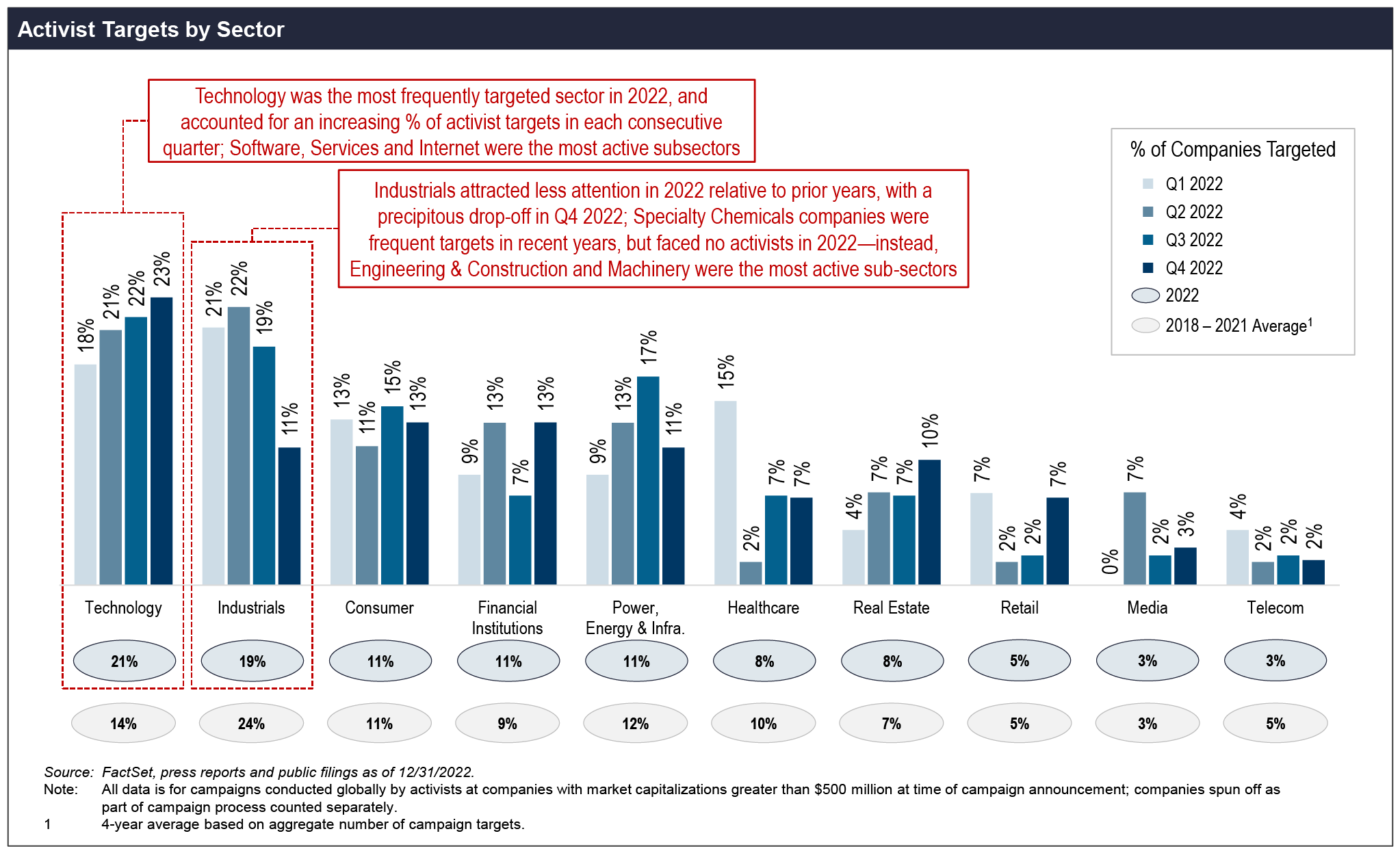

Technology was the most frequently targeted sector in 2022, representing 21% of activist targets; the extraordinary decline in valuations created an opportune environment for activists who approached the sector in record volumes—especially in the U.S., where the Technology sector accounted for 27% of 2022 campaign activity.

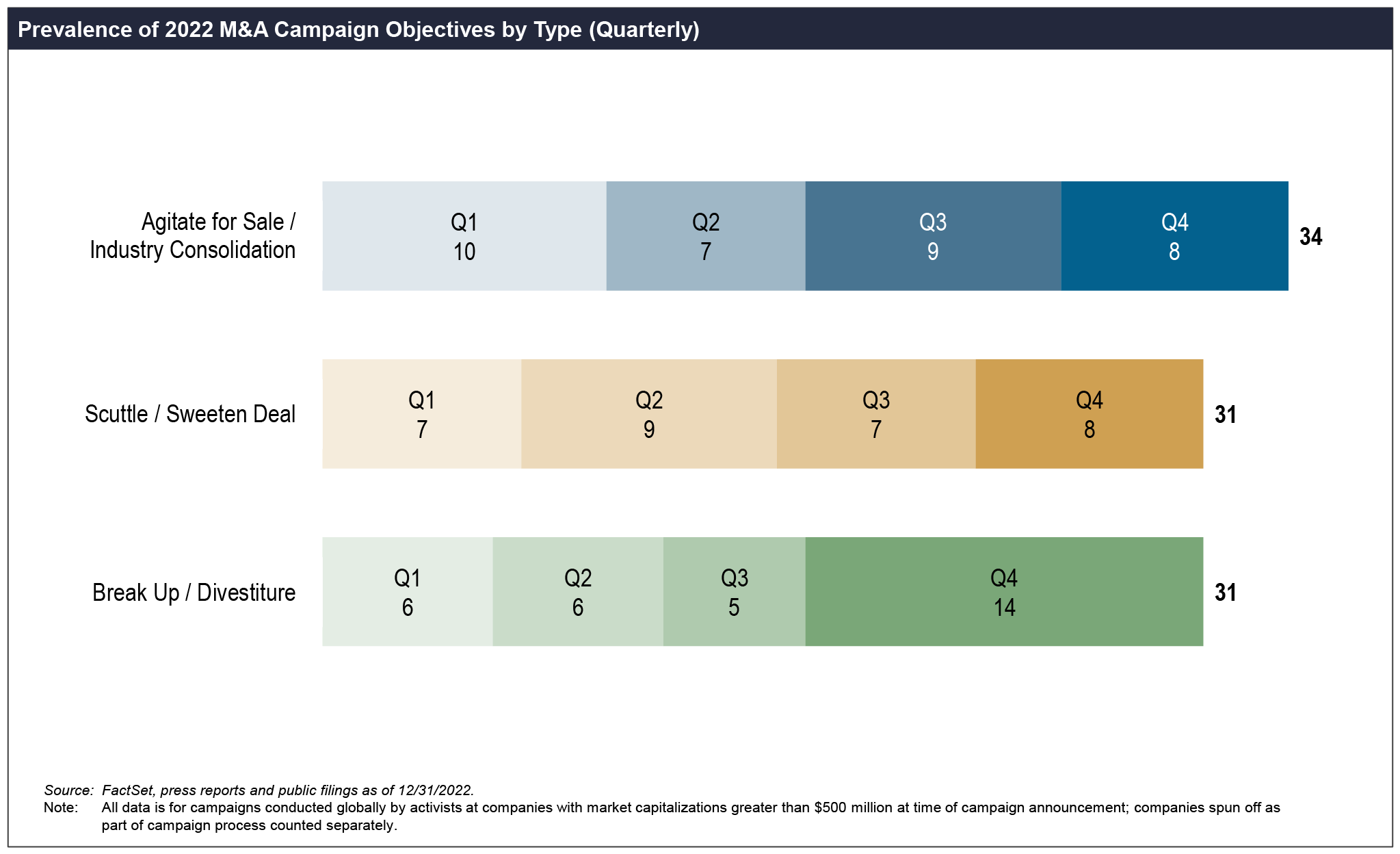

After a slow start to the year, M&A-related campaigns made a comeback by year-end and represented 41% of all 2022 campaigns. The rebound in M&A objectives was primarily driven by an increase in break up demands in Q4, as challenging market conditions shone a spotlight on the logic behind keeping disparate businesses together.

Finally, activists won 108 Board seats in 2022, representing a 21% y/y increase. With the universal proxy rule now in effect, and a majority of corporate advance notice deadlines occurring in Q1, the seasonal peak in Q1 2023 has the potential to be even more pronounced.