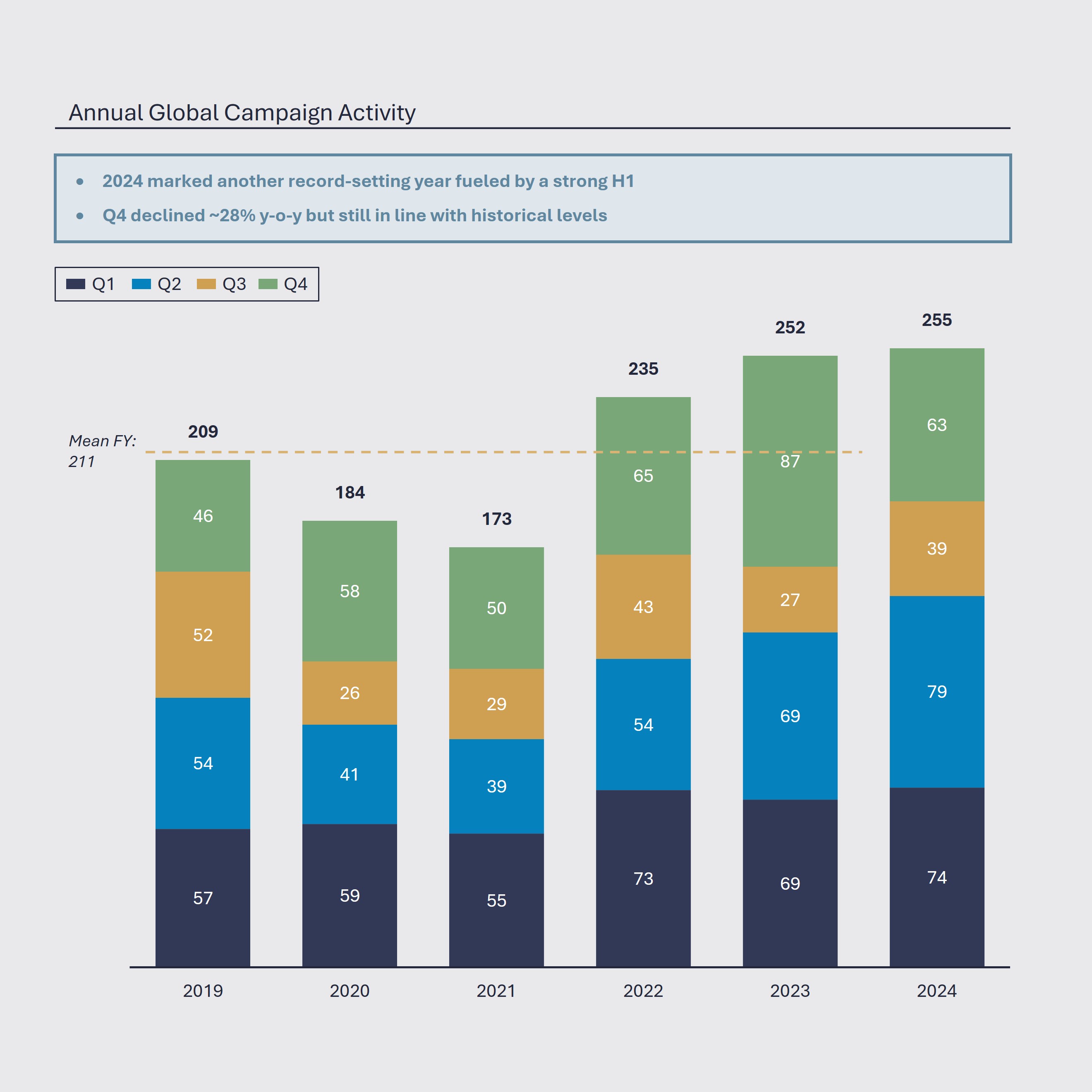

Global Campaign Activity Hit a New High in 2024

- In 2024, record activity in Q1 and Q2 led to a second consecutive year of record-setting campaign volume, despite the lowest Q4 and H2 activity since 2021

- The global activist universe expanded in 2024 with a record 186 investors launching campaigns, with first-time activists representing 47% of all activists and 32% of campaigns

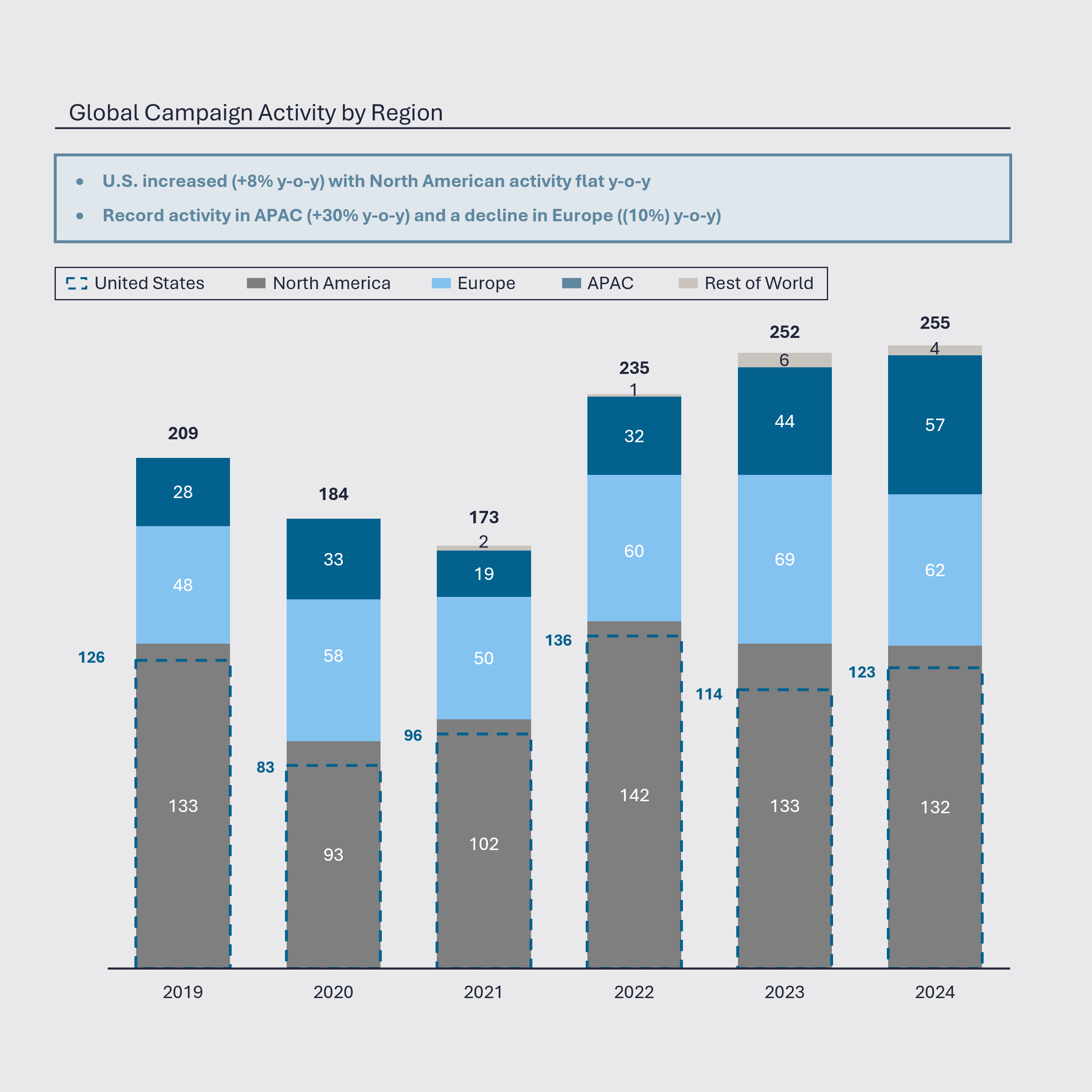

Global Campaign Activity by Region

- U.S. activity increased 8% year-over-year (123 campaigns), with an unusually consistent quarterly cadence throughout the year

- After a busy start to 2024 that featured a record-setting quarter for new campaigns in Europe (Q2 – 22 new campaigns), activity in H2 decelerated; 62 new campaigns launched in 2024 exceeded 5-year average levels but fell shy of 2023’s record (69)

- APAC activity reached a new high in 2024 with 57 campaigns launched, materially eclipsing the previous record of 44 set last year

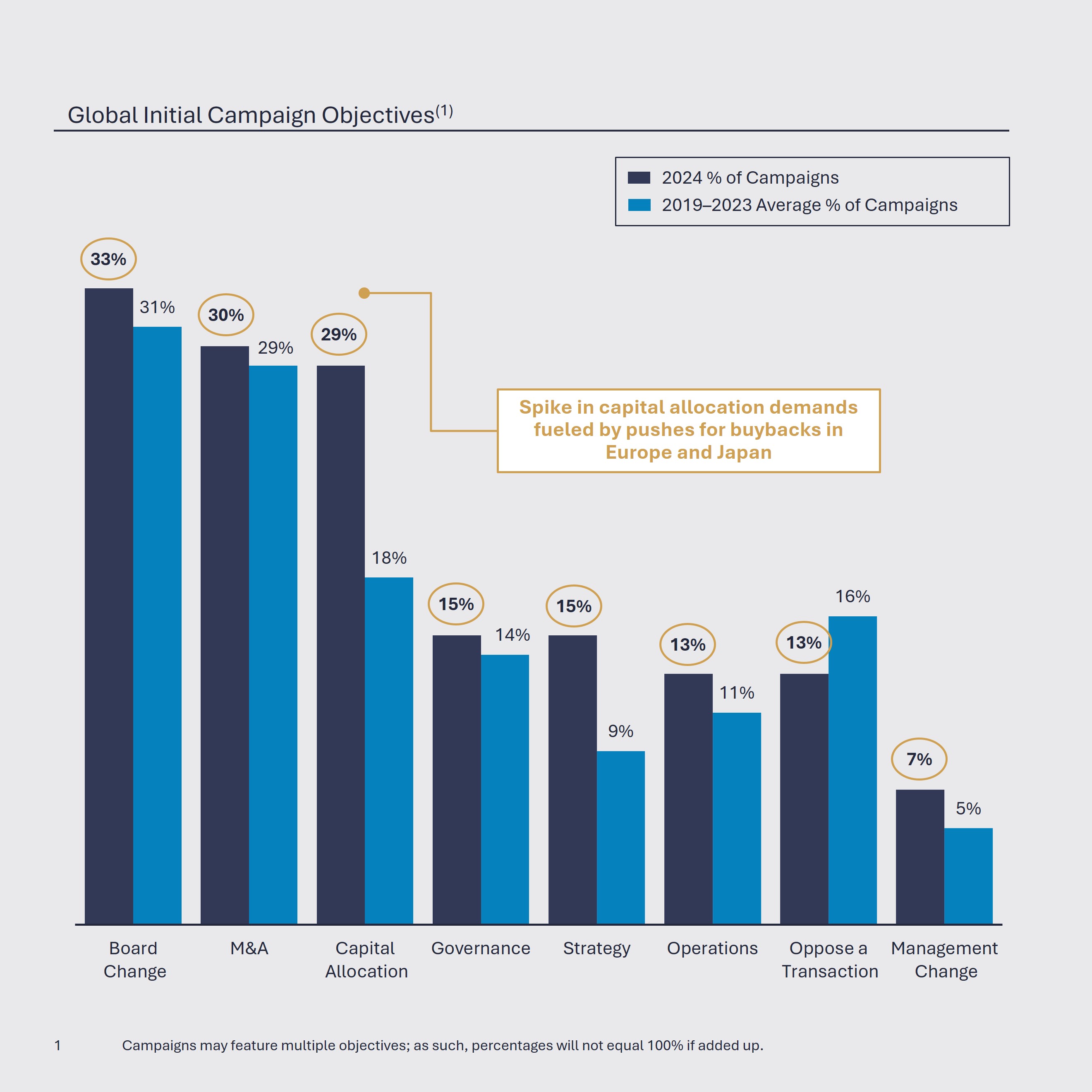

M&A and Capital Allocation Among Foremost Global Demands

- M&A remained a prominent global campaign objective, exceeding 5-year average levels and driven by strong activity in Europe

- Capital allocation demands also increased across regions (29% of campaigns vs. a 5-year average of 18%), with notable pushes for share buybacks in Europe and Japan

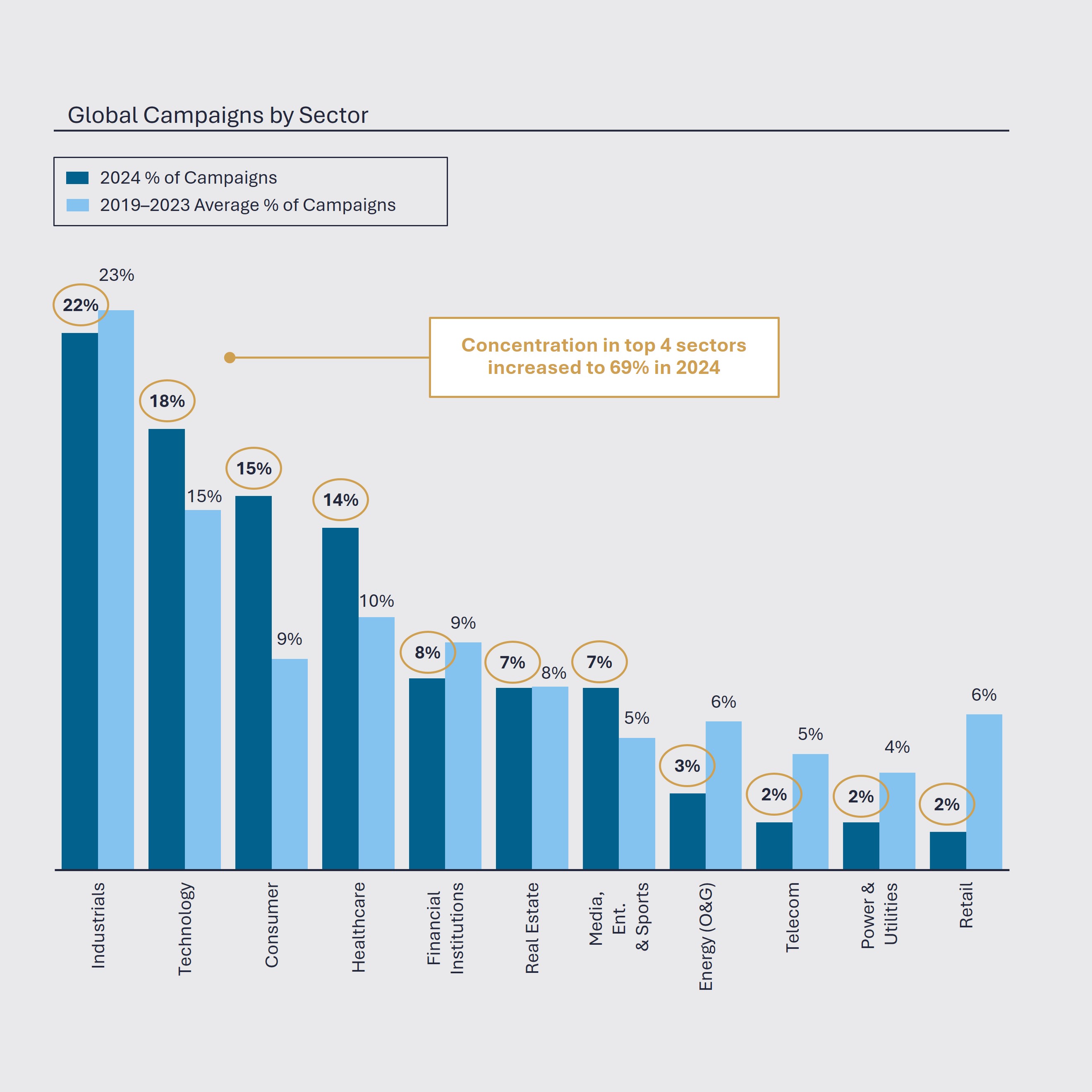

Sector Focus Differs by Region

- Technology was the most frequently targeted sector in North America, reaching an all-time high of 25% share, followed by Industrials, Consumer and Healthcare

- A significant European boom in Media, Entertainment & Sports M&A-focused activism drove share gains for the sector to 15% up from a 5-year average of 4%, while Financial Institutions and Consumer shared the top rank in Europe with 16% share each

- Asian activism was again dominated by campaigns against multi-industry conglomerates