Lazard’s Healthcare Group completed its fifth in-depth study of global healthcare industry leaders – this year focusing on the biopharmaceutical sector – surveying 211 biopharmaceutical industry leaders, including 171 C-level executives and 40 investors.

However, there have been signs of recovery, with some recent positive clinical data, higher trading levels, a resurgence of certain forms of financing, and increased M&A activity. It is hard to say yet whether or not the improvement is durable.

In this context, the 2022 Study was fielded in June, just following the May biotech market nadir. As such, respondents expressed some pessimism regarding recovery expectations for the market, and the drivers that would propel that recovery. Central findings include:

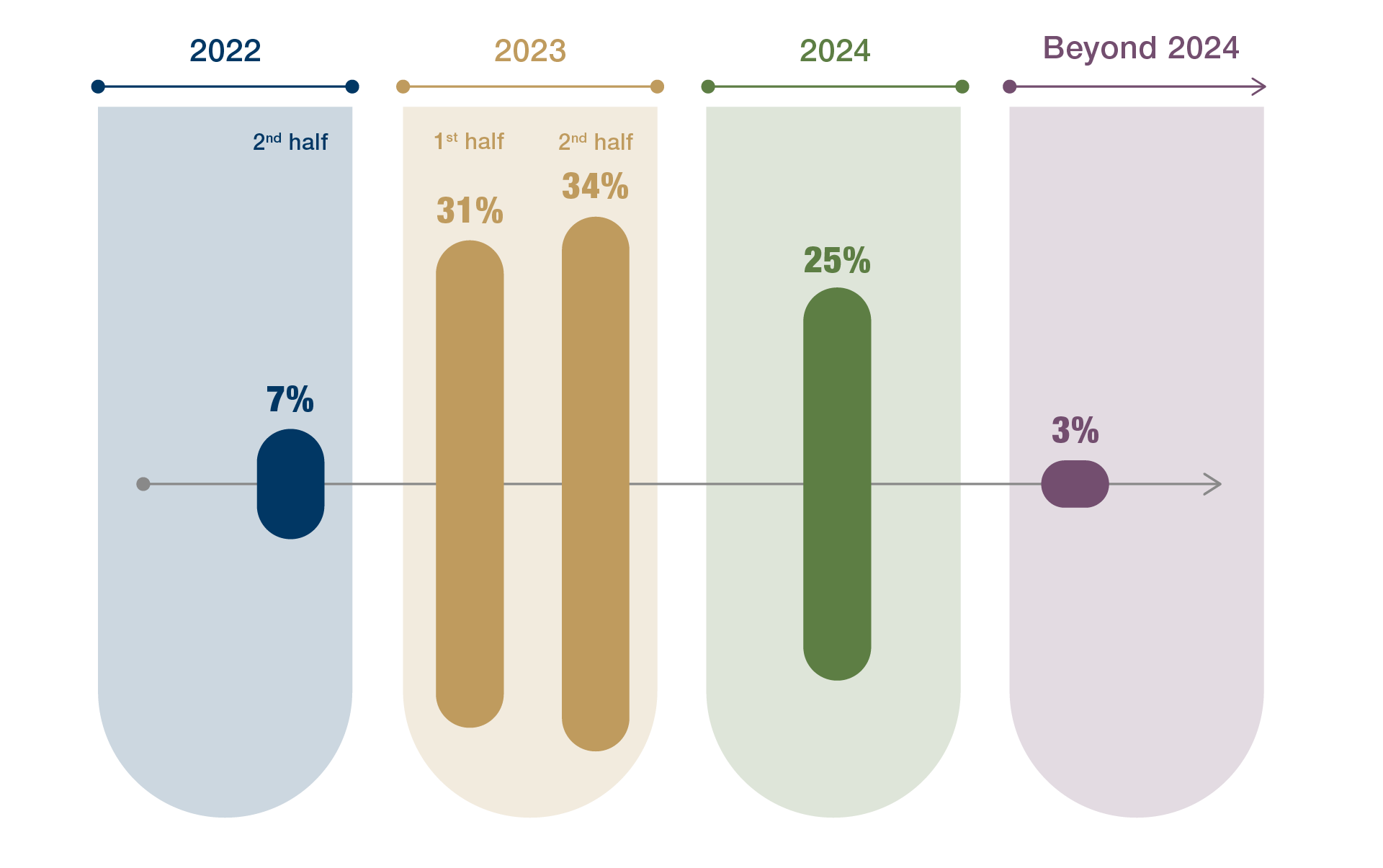

1. Biopharmaceutical market recovery is unlikely before the first half of 2023, and there is significant uncertainty about the timing of the recovery thereafter.

- Almost no respondents – just 7% – believe there will be a biopharma market recovery in 2022, and there is significant uncertainty about the timing of a recovery.

- While nearly all respondents share a bearish sentiment regarding a biopharma market recovery during the back half of the year, the majority believe that a recovery will occur in 2023, with opinion almost evenly split on a first-half or second-half recovery.

What are your expectations for the timing of a biopharma market recovery?

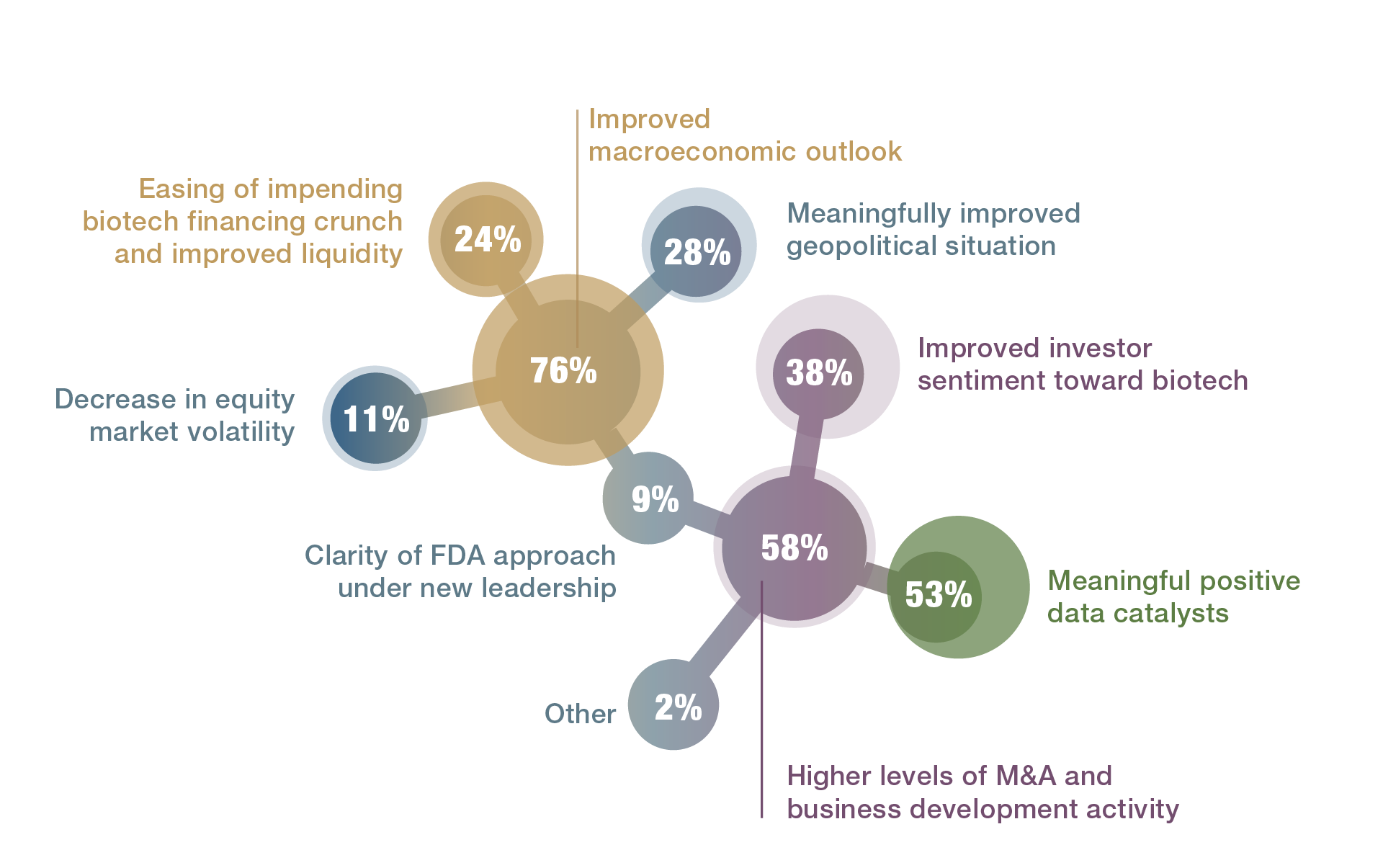

2. A more optimistic biopharma market sentiment will primarily be catalyzed by an improved macroeconomic outlook, higher levels of M&A and business development activity, and meaningful positive data catalysts

- Over three-quarters of participants (76%) believe that an improved macroeconomic environment – including tempered inflation, consensus on monetary policy and a better global growth outlook – will be the most important catalyst in improving the biopharma landscape.

- This key driver is closely followed by higher levels of M&A and business development activity (58%), and meaningful positive data catalysts (53%).

Which of the following potential catalysts will be the most important in improving the biopharma market outlook? (Select top three)

David Gluckman on the Findings of the 2022 Study

David Gluckman, Vice Chairman of Investment Banking and Global Head of Healthcare, discusses some of the most notable conclusions from Lazard's 2022 Biopharmaceutical Leaders Study, including the strong degree of optimism among survey respondents regarding the amount of innovation they expect to see in the industry going forward.