Our Key Findings:

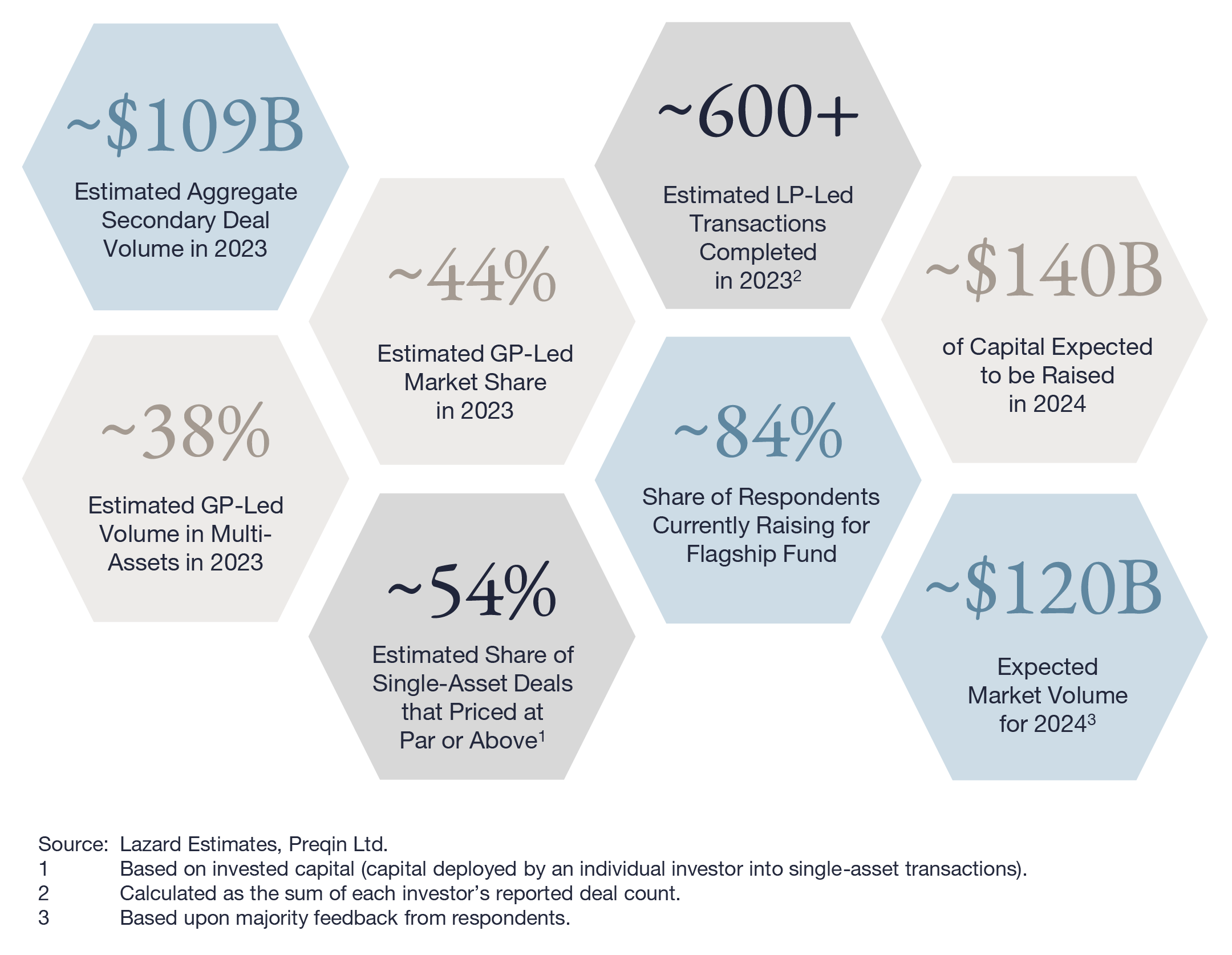

- GP-led transactions represented ~44% of the secondary market volume in 2023, with continuation funds dominating the GP-led market at ~78% of total volume

- Single-Asset Continuation Funds remained the most prevalent transaction type, representing ~39% of total GP-led market, but Multi-Asset Continuation Funds followed closely behind at 38% as diversified portfolios are gaining favor

- GP-led pricing fell in 2023 versus 2022, however, a large majority of transactions (~70% of total) are still being priced at or above 90% of NAV

- LP-led volumes landed at close to ~$61B in 2023 and we have witnessed higher deployment rates in the latter half of the year; we expect this momentum to continue into 2024 stemming from improved pricing and increased stability in the broader macro-environment

- We note a fourfold increase of sellers pursuing an LP-led secondary transaction to generate liquidity relative to 2022, as nearer-term monetization events remain limited

- Broadly speaking within LP-led transactions, we observed 50%+ of LP-led portfolio pricing continued to remain around 80-95%+ of NAV, with particularly strong pricing across buyout, credit and infrastructure strategies in developed markets