In our latest Consumer Pulse Survey with CH Consulting Advisors, we surveyed a demographically proportionate audience of more than 1,000 Americans on how they purchase and consume non-alcoholic beverages, how those habits have changed in the last year, and what they look for when choosing a new product. Our research focused on purchase and consumption of packaged water, flavored water, 100% fruit and vegetable juice, and the growing category of natural healthy beverages (NHBs), such as natural health shots, cleansing drinks, kombucha, antioxidant-rich fruit drinks, natural energy drinks (including canned ready-to-drink coffee or tea), gut health, and pro- or prebiotics.

Overall, each of these beverage categories remains strong, with portions of the population both purchasing and consuming frequently. However, digging into the specific consumer behavior around each beverage category yields insights into market stability, growth potential, and how investors and brands could capitalize on the opportunity presented by the different product groups.

Our Survey Results with Selected Exhibits:

The beverage buying habits of Millennial and Generation Z consumers (those born after 1981) differ starkly from older consumers in purchase frequency, beverage package size, and new product trial. While the stereotypical image of a young adult may be of a budget-constrained and eco-conscious consumer, we find that this cohort is highly engaged with the beverage category.

Exhibit 3 – Gen Z and Millennial consumers purchase more packaged beverages than older consumers, belying the assertion that younger consumers purchase less due to budget and environmental concerns

Frequent purchase (2-3x per month), by beverage type and generation

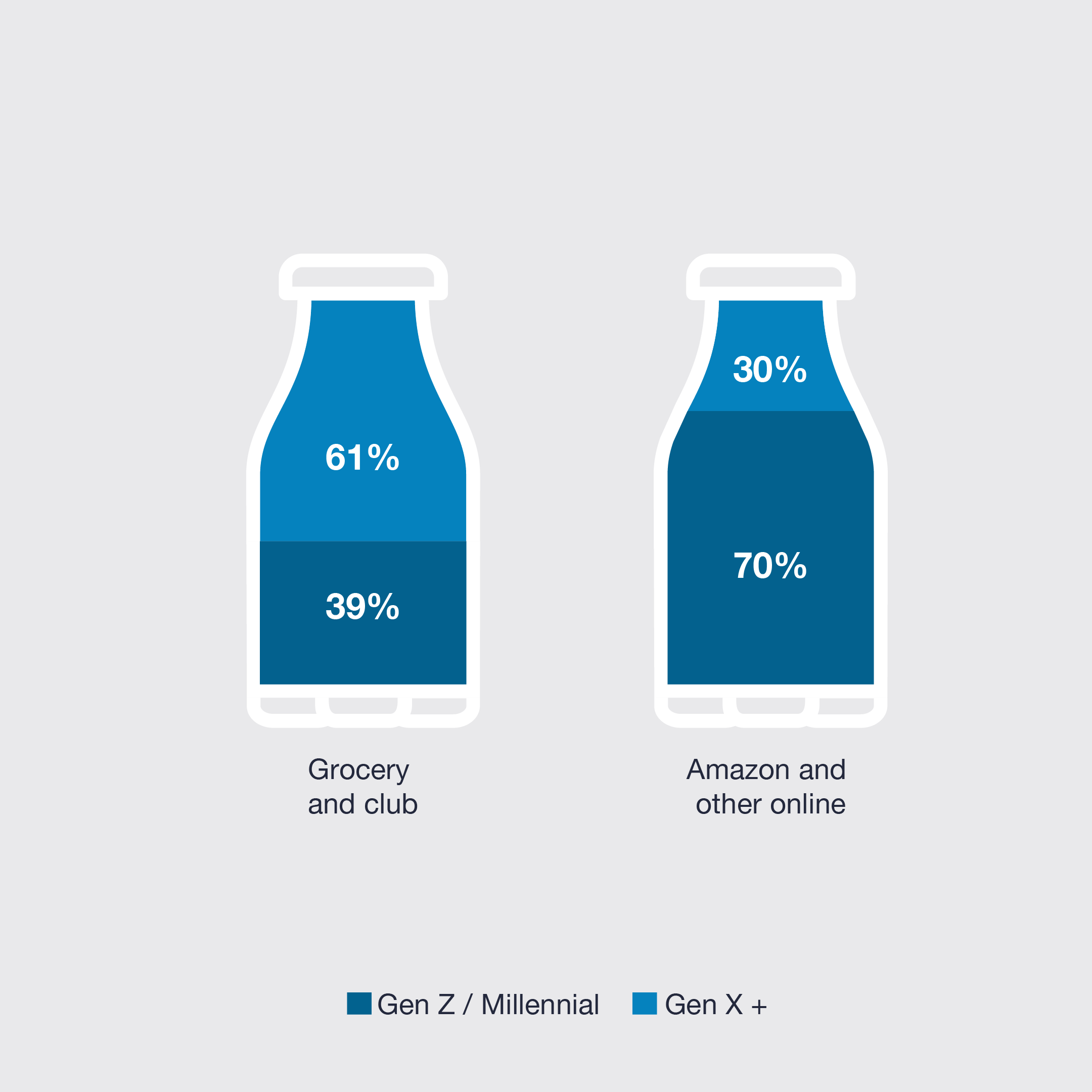

Just as Millennials and Gen Z are the most prominent cohort leading online purchasing in general—with some estimates stating over 60% of their total purchases are made over the internet—these generations continue to be the most prominent cohort for online beverage transactions as well.

Exhibit 7 – Younger consumers are 70% of the market for purchasing beverages through online channels

“Where do you most frequently purchase your beverages?” Percent of people choosing channel, by generation

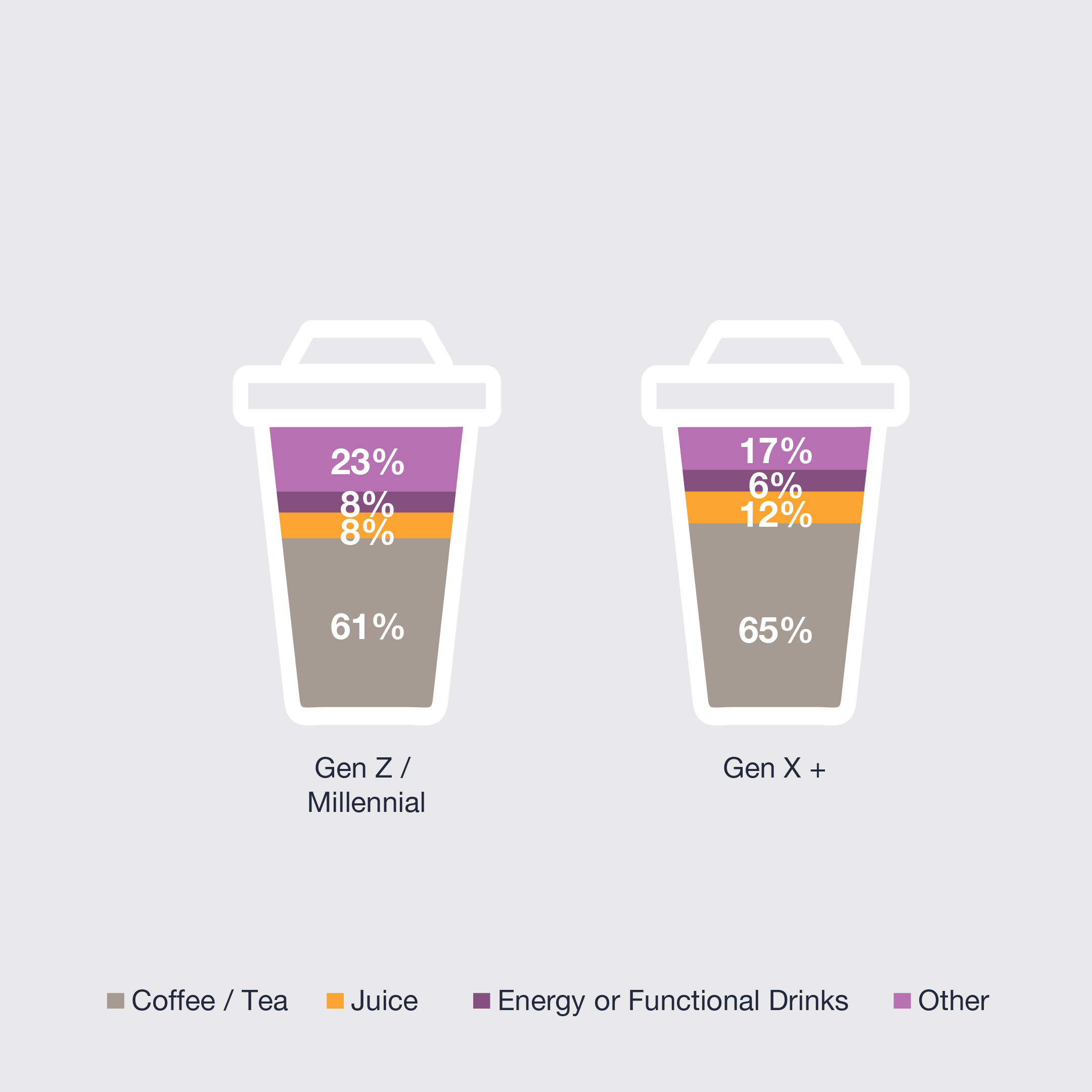

One thing that younger and older consumers continue to have in common is their reliance on coffee and tea for their morning pick-me-up.

Exhibit 8 – Morning pick-me-up

Primary drink of choice for occasion

The category of natural healthy beverages (NHBs) has emerged as a true contender over the past decade, competing against existing functional or energy drinks with a promise of fewer ingredients but additional functional benefits provided naturopathically thanks to superfoods, pre- and pro-biotics, and infused botanicals. According to our survey, digestive health is the second most common benefit sought by consumers, behind only immunity support.

Exhibit 9 – NHB: Most important health benefits

Percent of people selecting benefit as one of their top three reasons for purchase

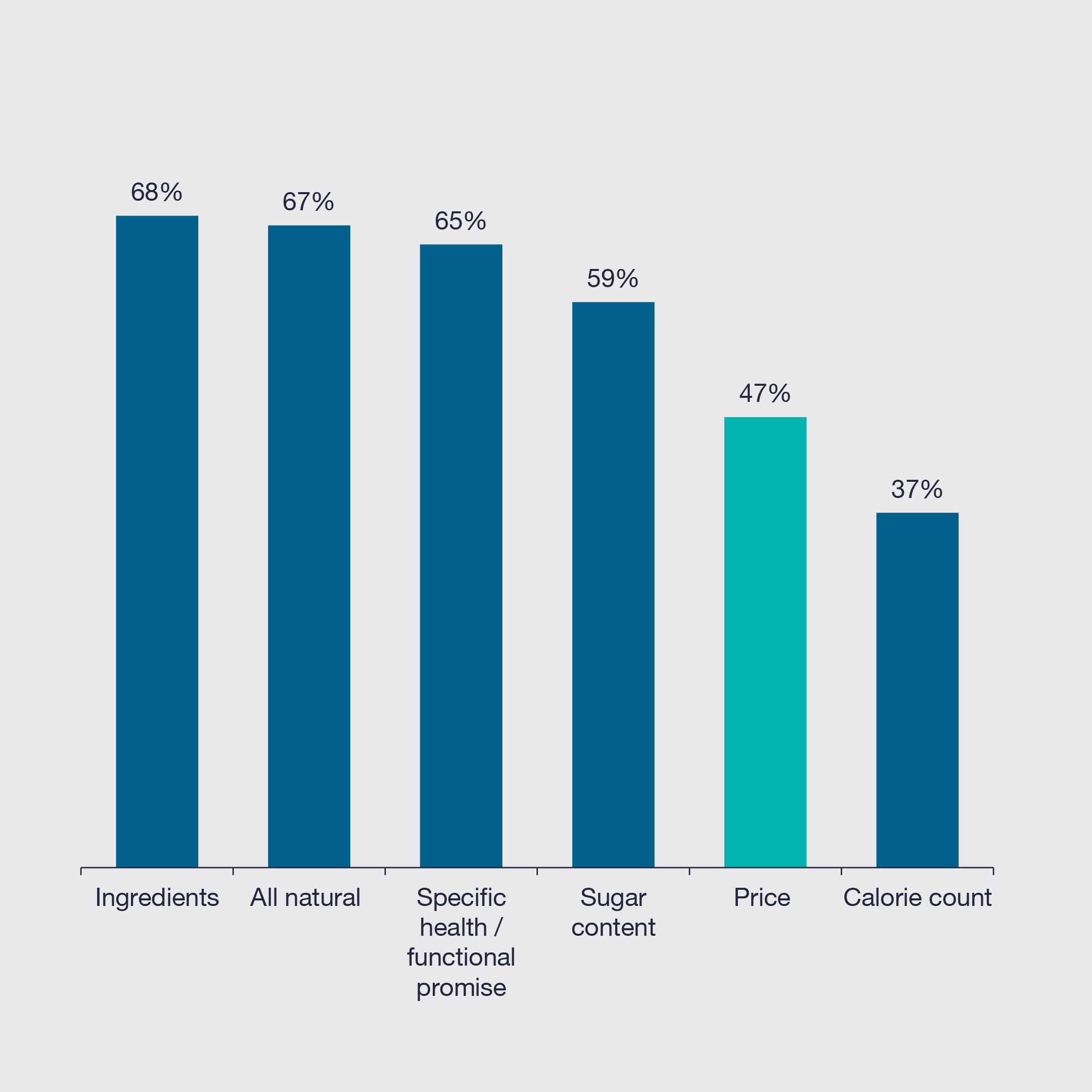

When selecting and purchasing natural healthy beverages, consumers are consistently less concerned about the price than they are about the quality and effectiveness of the product.

Exhibit 13 – Price is less important than many product characteristics for NHB consumers

Important NHB characteristics

(Percent selecting top two boxes on a 1-7 scale)

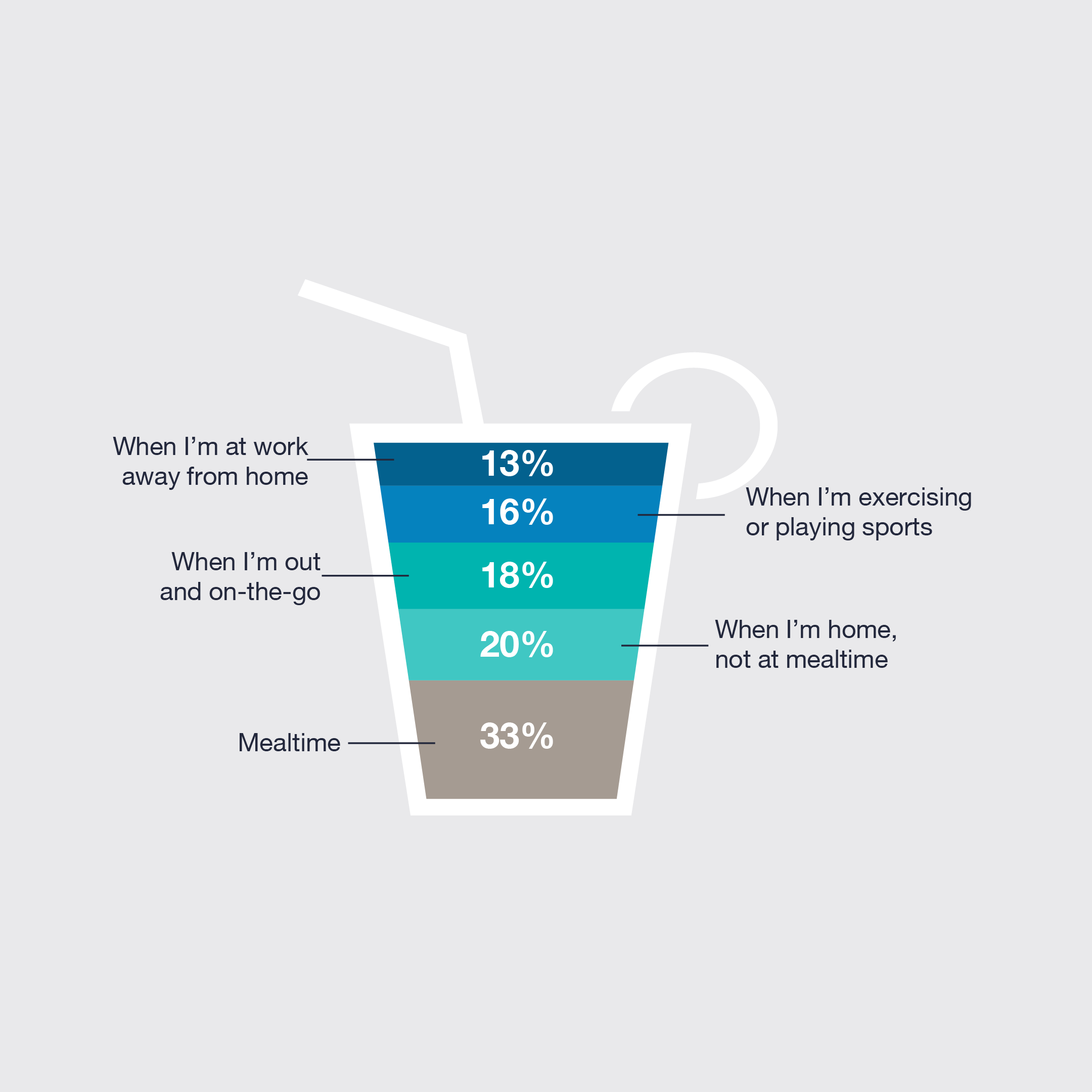

Natural healthy beverages have become “anytime” drinks—consumed throughout the day, not just at mealtime.

Exhibit 14 – Usage Occasions

“Which of these describe when you generally drink NHB?”