Fortunately, the prospects for equities are not entirely driven by GDP forecasts. The potential benefits of generative artificial intelligence combined with surprising economic strength through 2023 have lifted spirits and valuations in the equity markets, and boosted confidence in boardrooms that the economy and investors will endure the economic softness and emerge more resilient on the other side.

While the markets are unlikely to trace an uninterrupted upward trajectory, prospects are looking brighter than they have for some time.

Indeed, there are green shoots in the biopharma equity markets. Biopharmaceutical innovation continues to advance broadly, deeply and rapidly. Numerous companies have reported exciting clinical data and transaction activity has accelerated. Investors have been more positive than they were in 2022, but they are still risk averse and deploying capital into de-risked assets, creating a “haves” and “have-nots” environment. Additionally, the industry is grappling with a challenging regulatory environment in light of the IRA and the anti-trust climate.

Against this backdrop, this year’s Global Biopharmaceuticals Leaders Study was fielded in June and July 2023. This year’s study included participation from 267 leaders across many of the largest biopharma companies globally, as well as smaller public and private companies, and prominent investment firms. The respondents encompass 226 C-level corporate executives and 41 leading investors. Among the C-level executives, 20 are from large-cap public companies, six from mid-caps and 117 from small-caps, while 83 are from private companies.

Our Central Findings:

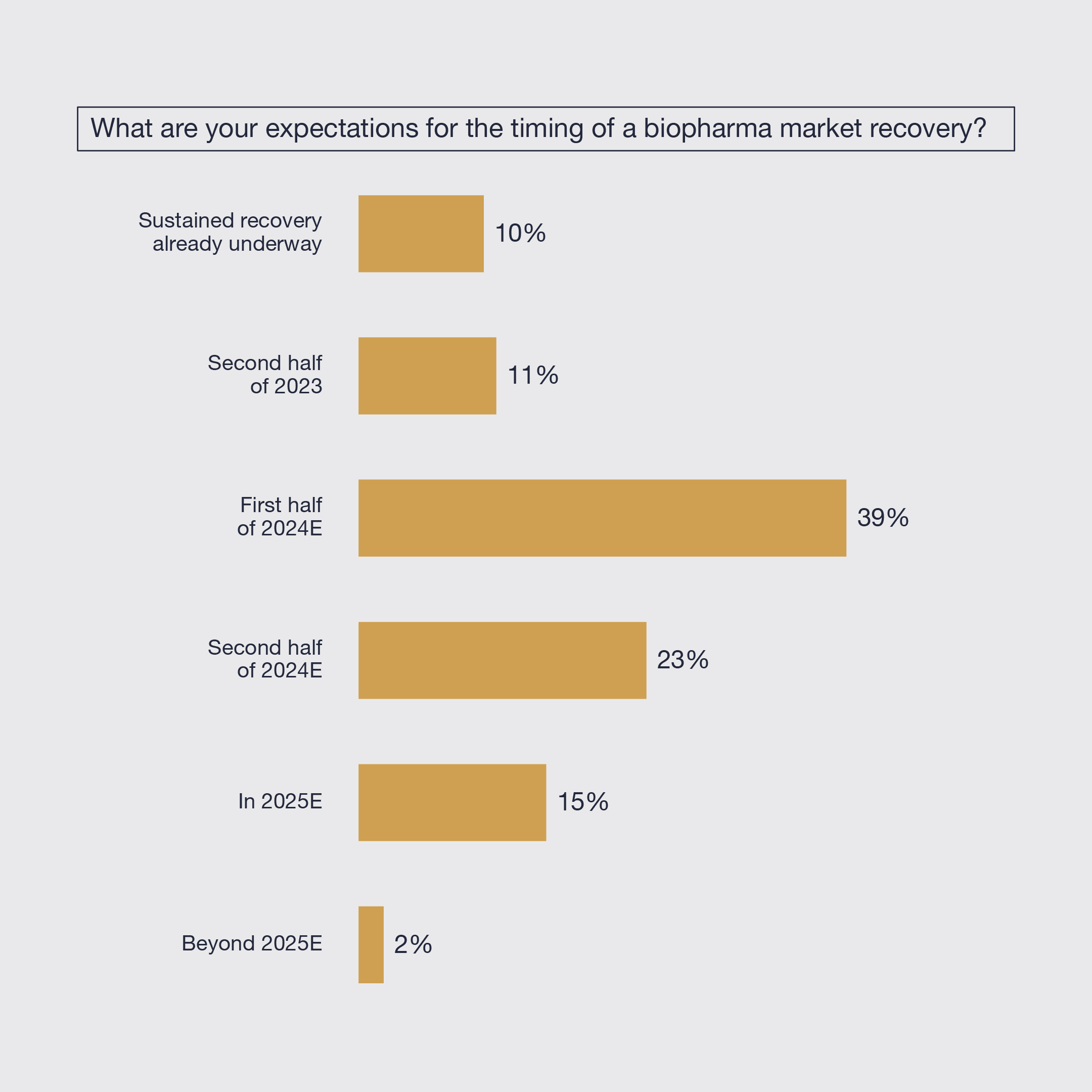

1. Valuations for biopharma companies are expected to remain stable ahead of an anticipated sustained equity market recovery in the first half of 2024. While an improved macroeconomic outlook and increased M&A activity are expected to be catalysts of recovery in the near term, access to capital and rate of company formation during the next cycle are not expected to return to the levels seen over the previous cycle.

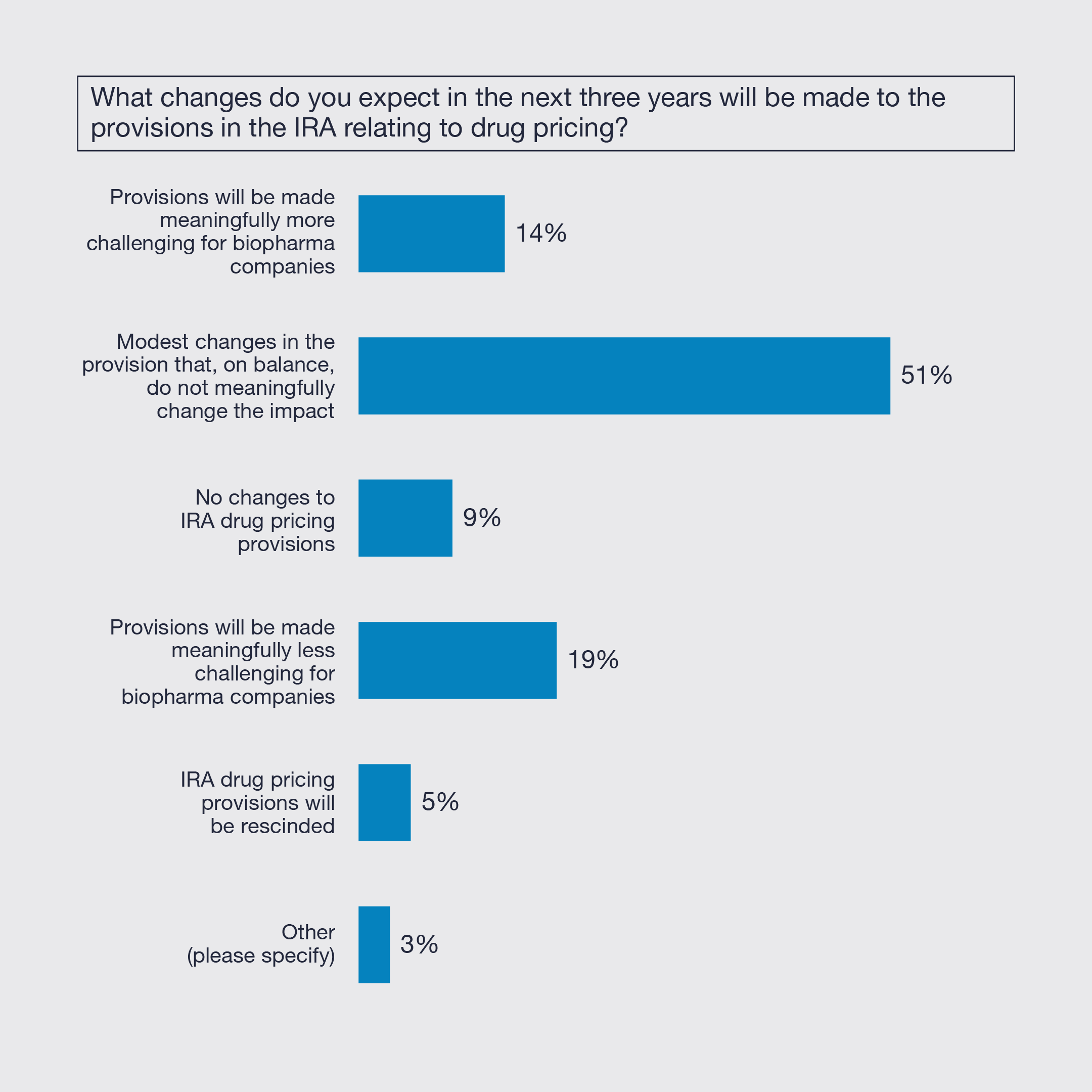

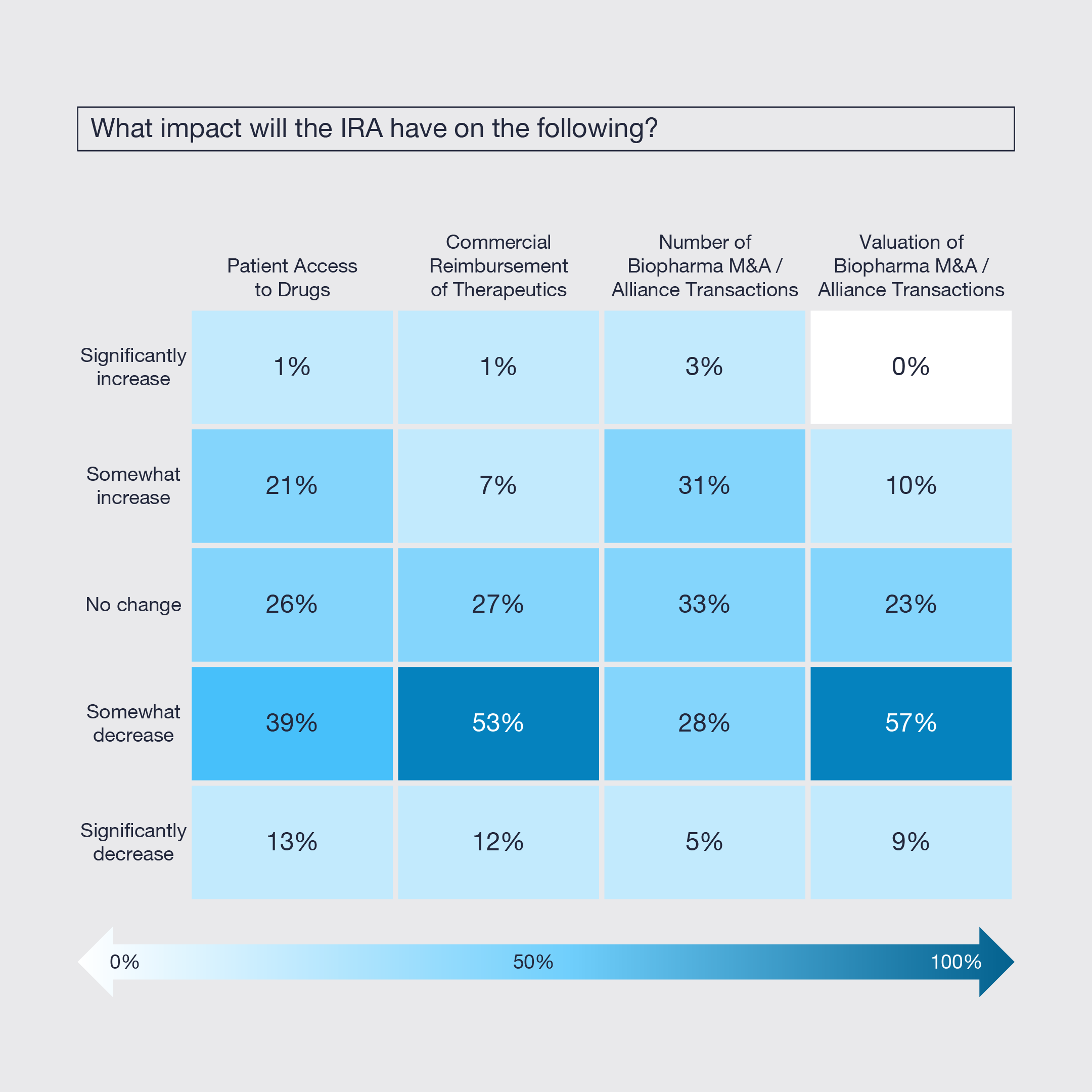

2. Biopharma executives anticipate that the IRA is here to stay with minimal changes to the current drug pricing provisions in the near term. Consequently, the IRA is expected to drive increased clinical development of biologics and drugs that target populations and diseases subject to commercial reimbursement, with modest impact on patient access to drugs and M&A activity.

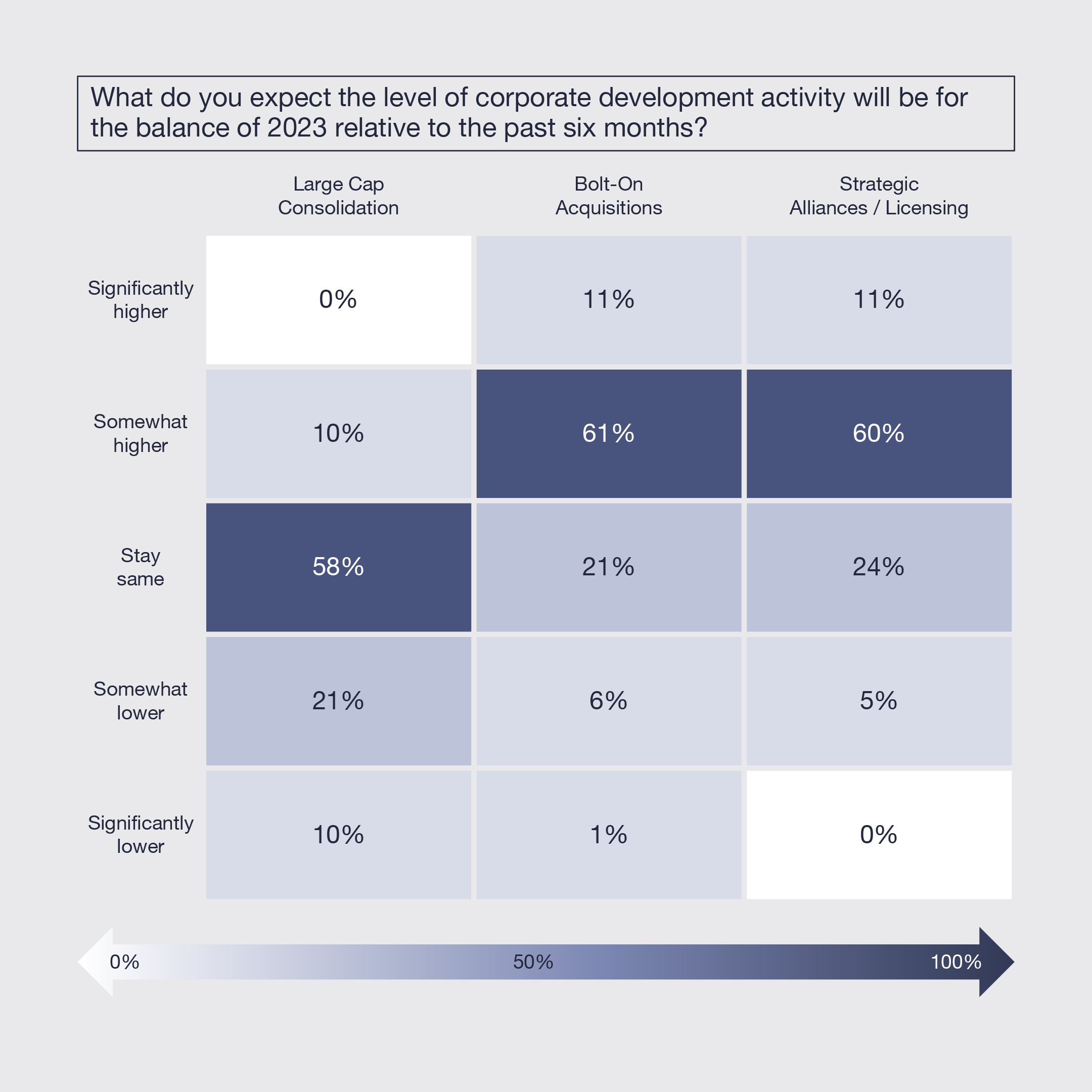

3. While large-cap consolidation is expected to remain at the same relatively low level, bolt-on acquisitions – together with partnerships/collaborations – are expected to increase. Ongoing limited access to capital, improvements in seller price expectations, and buyers’ need for growth will be important catalysts of rising strategic activity.

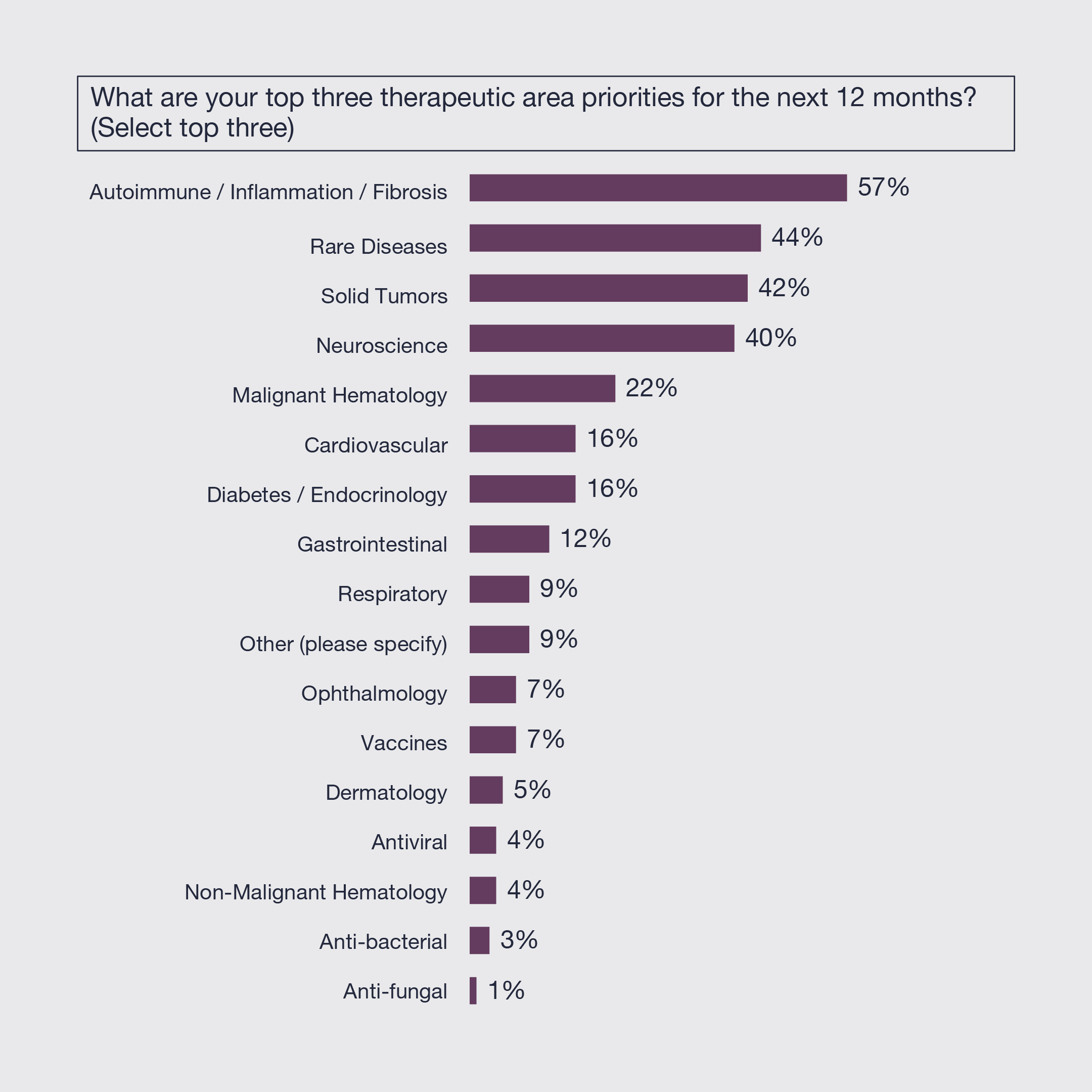

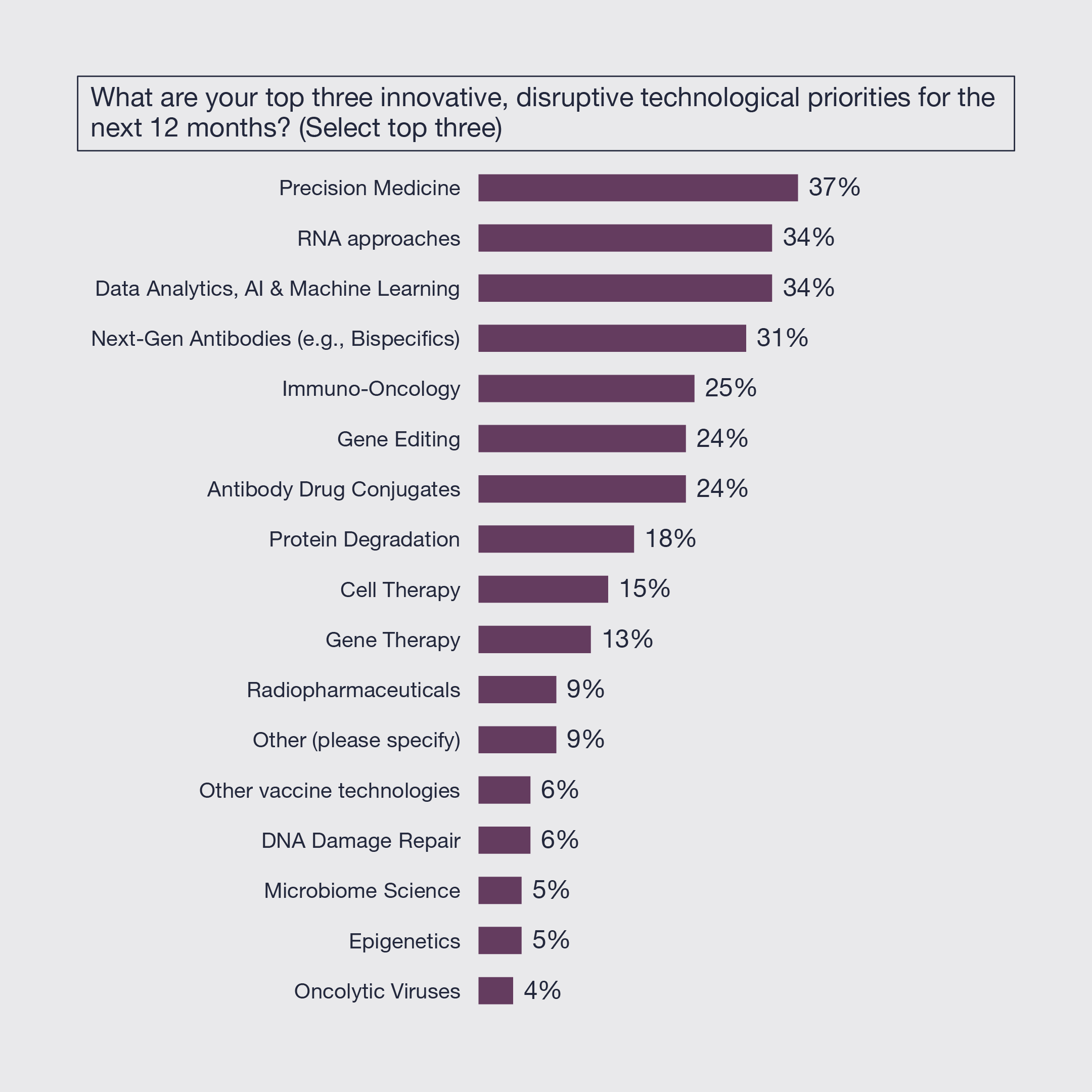

4. Autoimmune, inflammatory, and fibrotic diseases are the top therapeutic area priority, followed by rare diseases, solid tumors, and neuroscience. Views on the top innovative modalities remain widely distributed reflecting the exciting breadth, depth and pace of innovation. Focus has shifted away from gene, cell therapy and protein degradation and more toward precision medicine, data analytics, Artificial Intelligence (AI) and Machine Learning (ML), and next-generation antibodies.