Against this backdrop, we fielded this year’s Healthcare Services Leaders Study in December 2023. This year’s study included participation from 183 leaders across many of the largest healthcare services companies, as well as smaller public and private companies, and prominent investment firms. The respondents encompass 121 C-level corporate executives and 62 leading investors. Among the C-level executives, 11 are from large-cap public companies, 23 are from SMID-caps and 87 are from private companies.

Our Central Findings:

1. Healthcare services equity market conditions are not expected to recover to normalized, sustainable levels conducive to IPOs before the second half of 2024 or 2025. An improved macroeconomic outlook, greater access to capital and improved investor sentiment toward sector profitability are the factors expected to catalyze a market recovery.

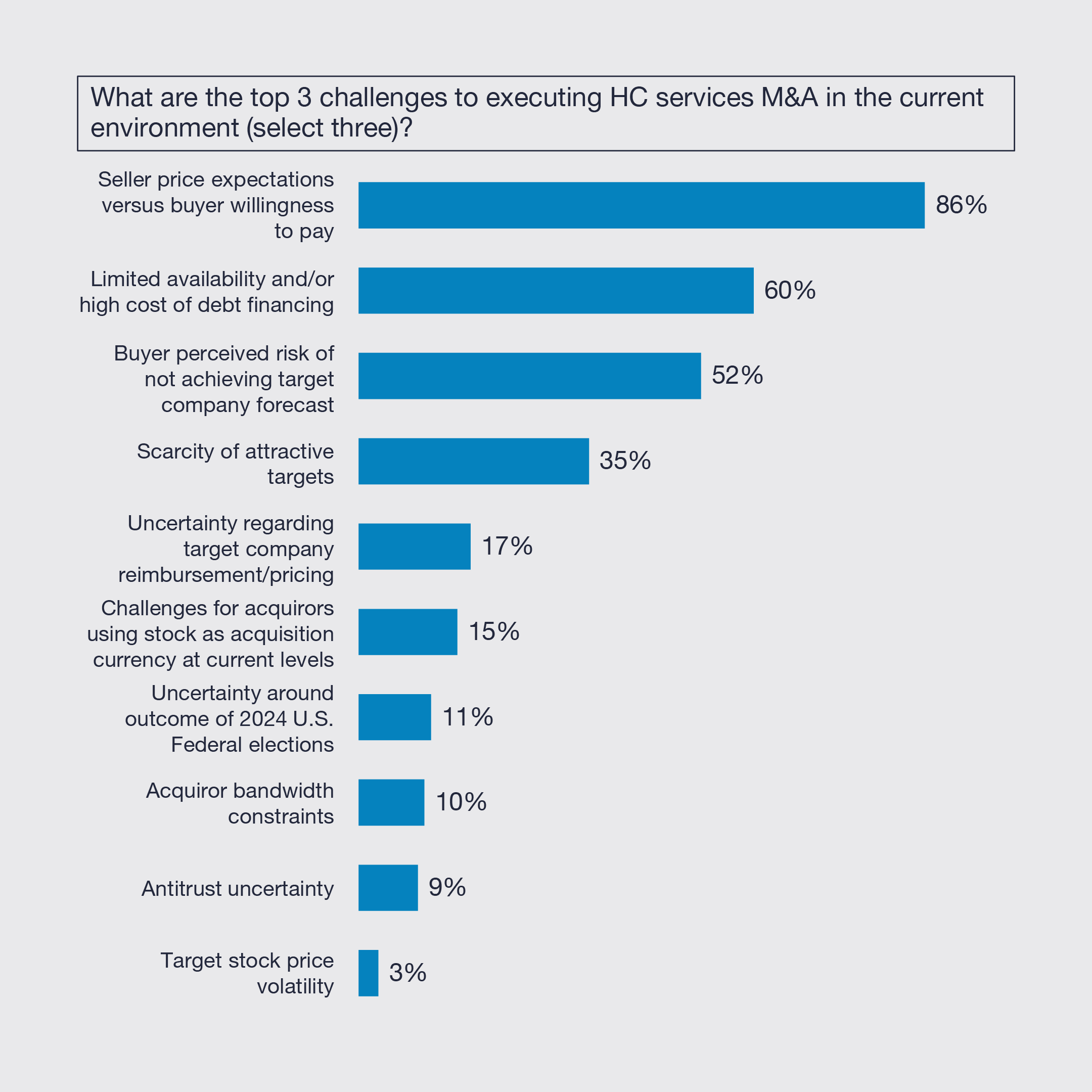

2. While views are split on whether large-cap consolidation will increase or stay the same in the first half of 2024, private equity platform acquisitions, bolt-on acquisitions and corporate carve-outs are expected to increase. Greater alignment of buyer and seller price expectations, greater availability of affordable financing and lower perceived risk among buyers in achieving target company forecasts will be important catalysts of rising strategic activity.

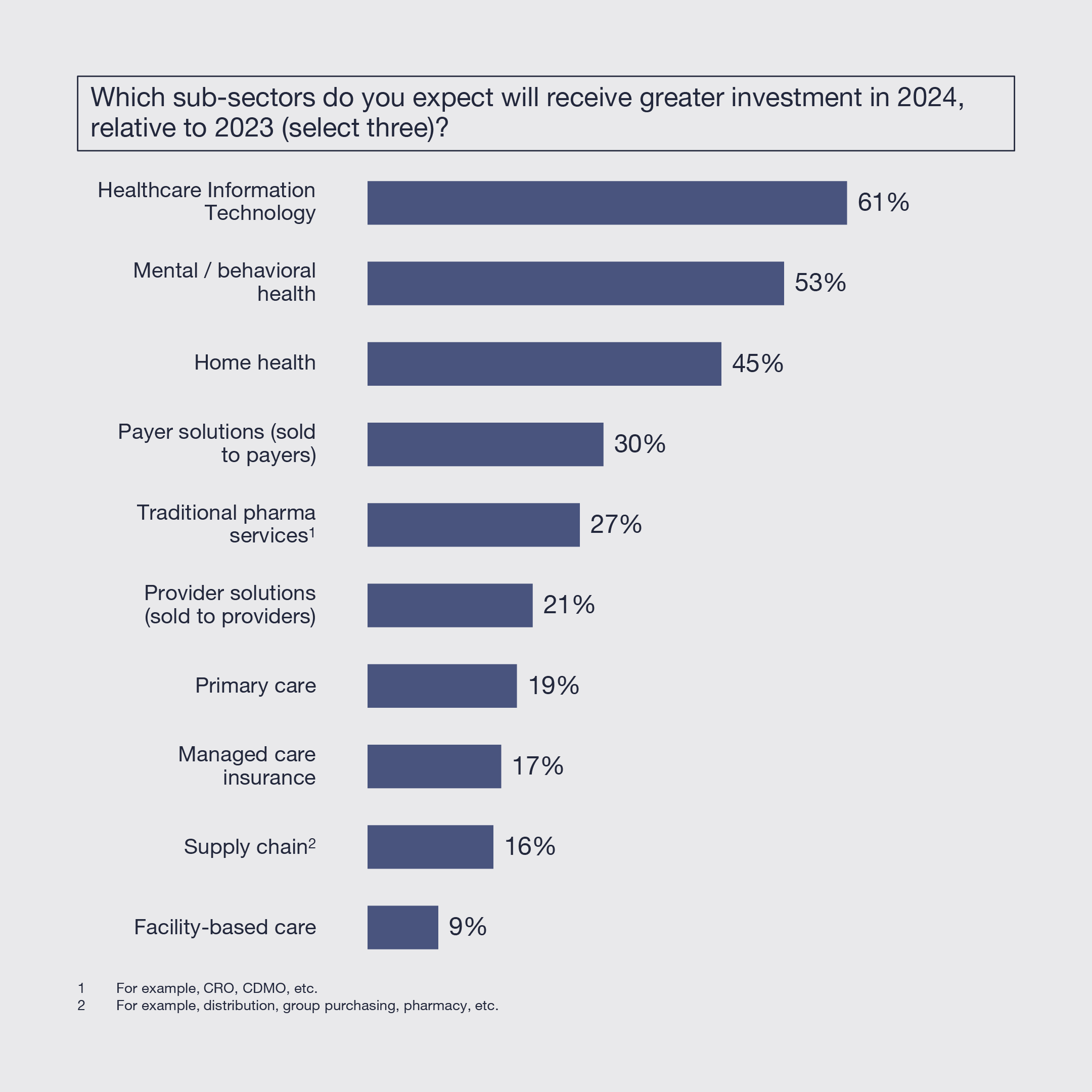

3. Healthcare IT (“HCIT”), mental / behavioral health and home health are expected to receive greater investment in 2024 than in 2023, followed by payer solutions and pharma services. Respondents believe that facility-based care and supply chain are the areas least likely to receive greater investment in 2024.

4. Greater adoption of artificial intelligence / machine learning (“AI/ML”) is the force expected to most transform healthcare services over the next decade, followed by the shift of care volume to alternative sites and the transition to value-based care. AI/ML is expected to drive the most improvement in areas such as clinical decision support, revenue cycle management and administration / operations.

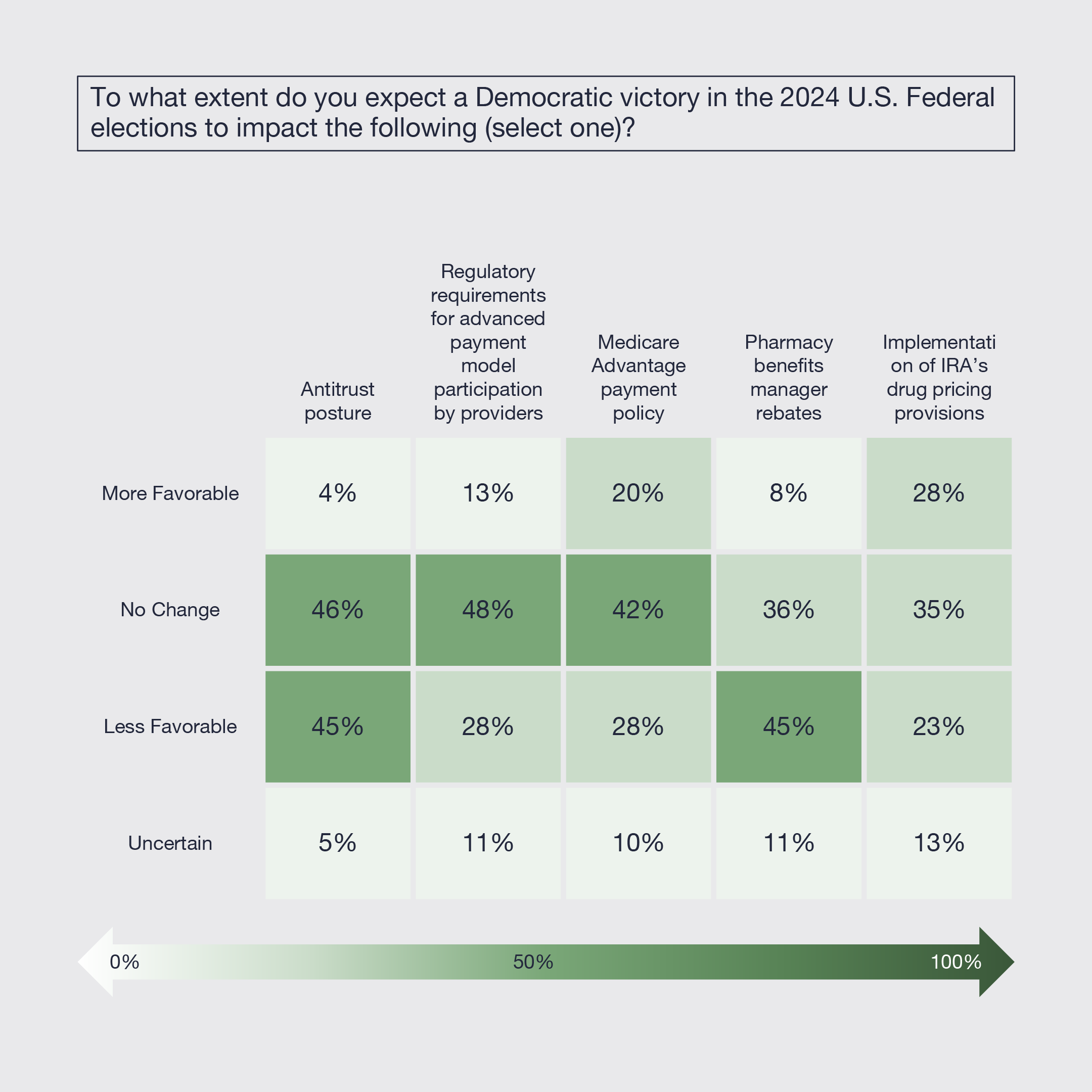

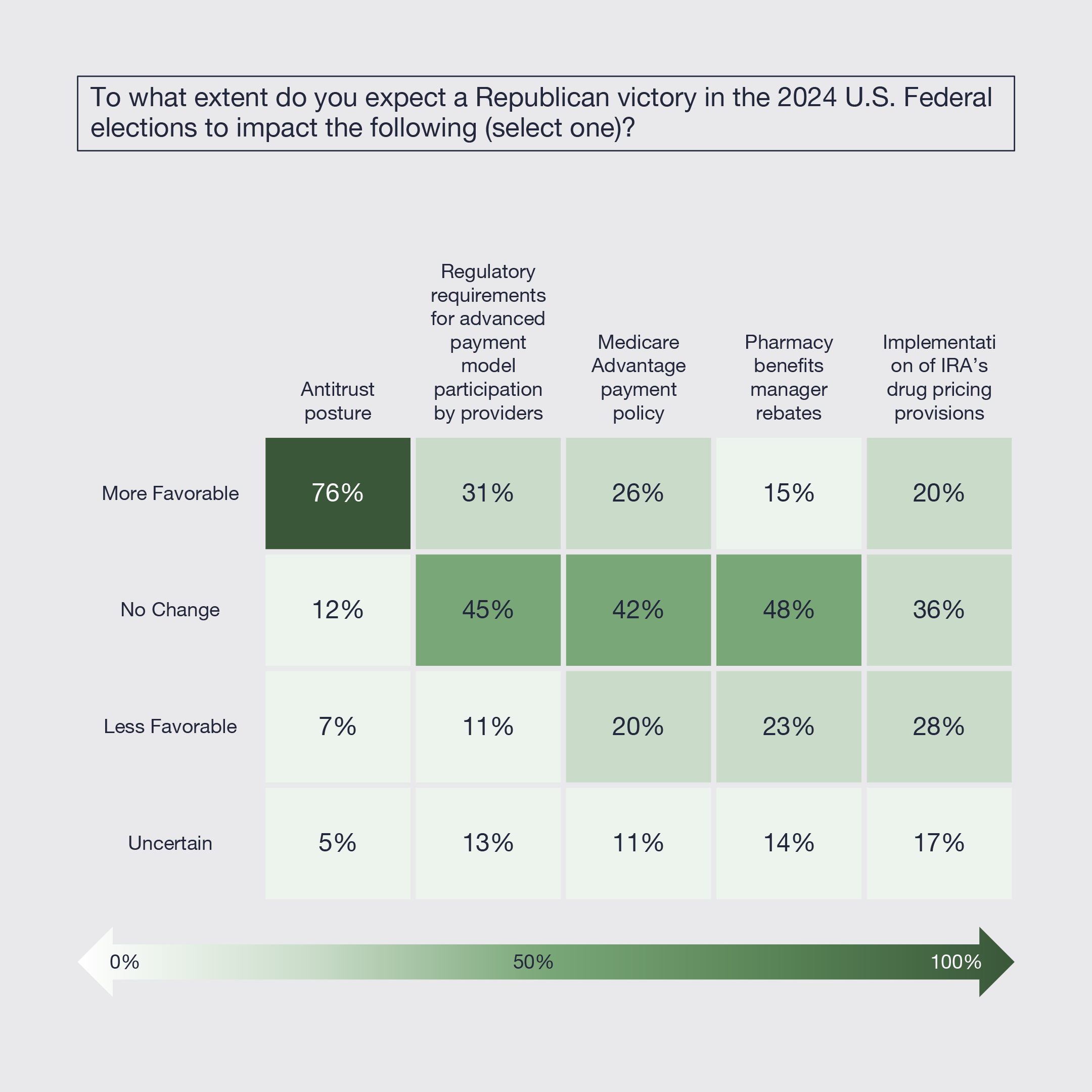

5. Healthcare services leaders believe that a Republican victory in the 2024 U.S. Federal elections would lead to a more dovish antitrust environment and that a Democratic victory would lead to lower rebates for pharmacy benefits managers (“PBMs”). On the other hand, they do not believe the outcome of the elections will have a meaningful impact on value-based payment model participation, Medicare Advantage payments or the implementation of the drug pricing provisions of the Inflation Reduction Act (“IRA”).