Key Report Findings

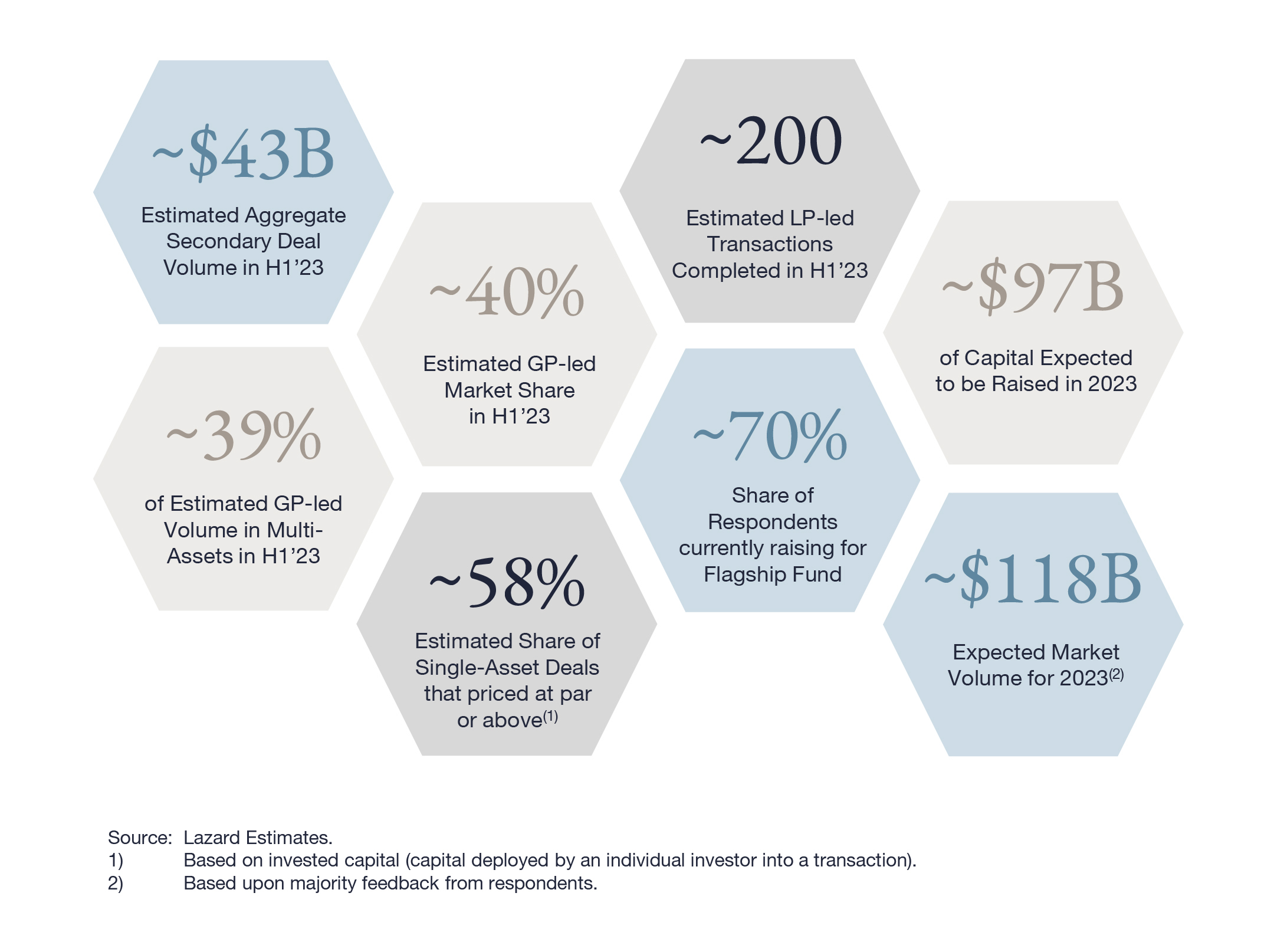

- 70% of respondents were raising capital for their flagship vehicles during the first half of 2023. Intense fundraising activity has led to enhanced valuation scrutiny and a flight to quality

- Single-asset transactions priced most favorably across the market: around 60% of single-asset transactions priced at par or above, compared with only 5% of LP-led transactions, illustrating continued strong appetite for trophy businesses

- 70% of mid-market sponsors launched continuation funds equivalent to 50% or more than the size of the latest flagship fund

- LP-led activity formed approximately 60% of the secondary market in the first half of 2023, driven by overallocation issues among several large North American LPs and ongoing secondary buyer interest in diversified portfolios

Outlook for the Remainder of 2023

Looking forward, our survey suggests that market volumes will reach approximately $118 billion* in 2023, the second-highest volume on record in the secondary market. We are optimistic for a number of reasons, including:

- Tighter bid/ask spreads in LP-led portfolios, as seen with marked improvement in pricing for LP-led portfolios towards the end of the first half of 2023

- Growing pressure on sponsors to provide their LPs with exits and lock-in DPI will create strong momentum in the GP-led segment globally

- As further closings occur over the remainder of the year, secondary capital will replenish to support more favorable market conditions in the second half of 2023 and into early 2024

* based on majority feedback from respondents