Lazard Geopolitical Advisory (LGA) is closely monitoring the changing geopolitical environment. Here are three of the most important trends to watch for the coming year.

Global Trade Chain Reaction

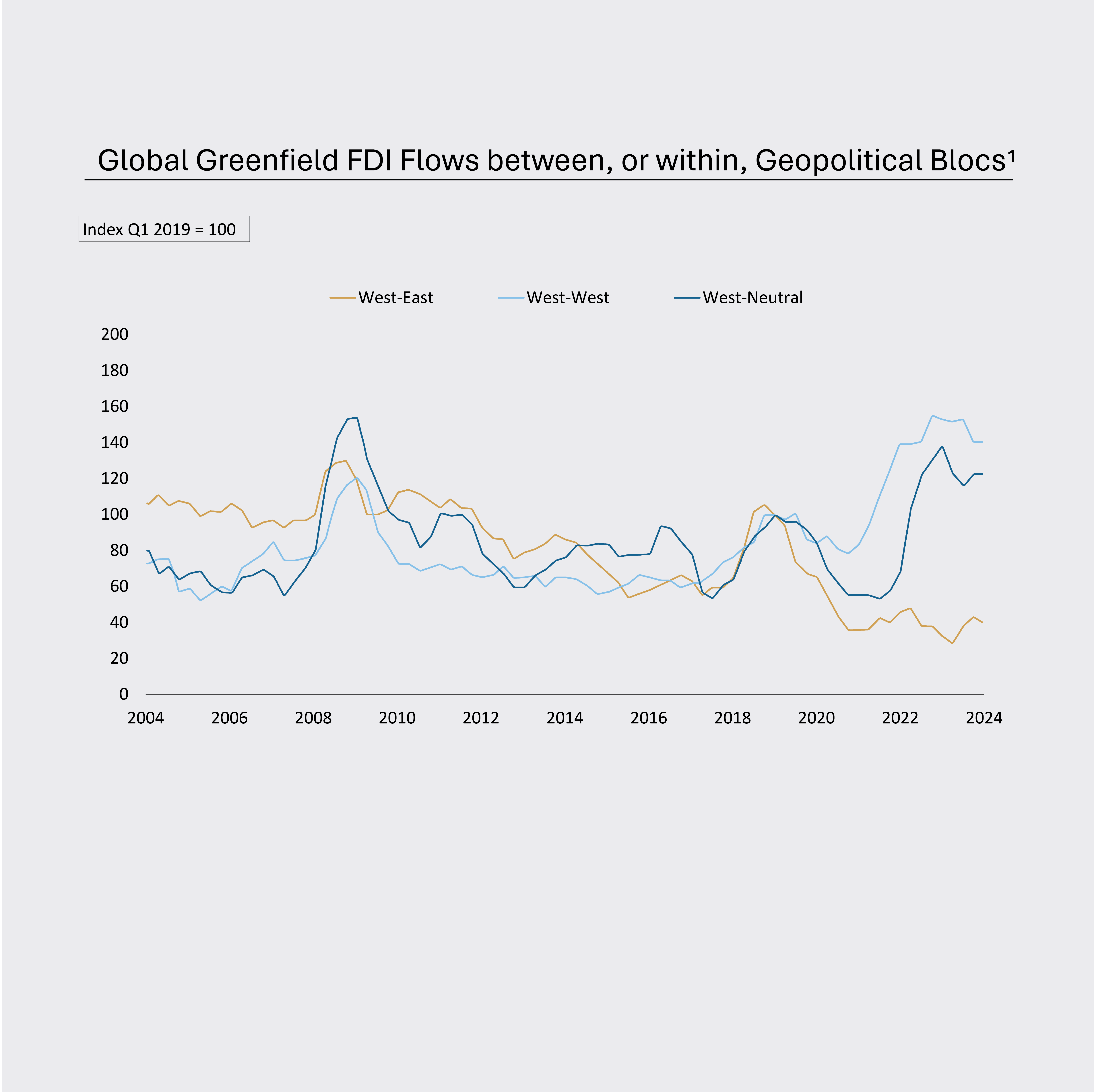

In 2025, globalization may become more fractious and uncertain as the US pursues a potentially more protectionist economic approach. Proposed tariffs of 60% on China and up to 20% on all trading partners would upend the status quo and accelerate a rewiring of global trade flows. Key targets include the EU, Mexico, Canada, China, and Vietnam. Even partial implementation of these tariffs could disrupt global trade patterns – especially when one takes into account potential retaliation by trading partners.

1 Centre for European Policy Research, 2024. West-East, West-West, and West-Neutral FDI flows are based on the European Central Bank’s index of geopolitical alignment which uses four proxies of political alignment between countries: the number of times a country has been sanctioned by Russia or China vs. the United States; the share of military imports from Russia and China vs. from the US; whether a country participates in the Belt and Road Initiative; and UN voting data regarding a country’s position on Russia’s invasion of Ukraine.

The European Union at a Crossroads

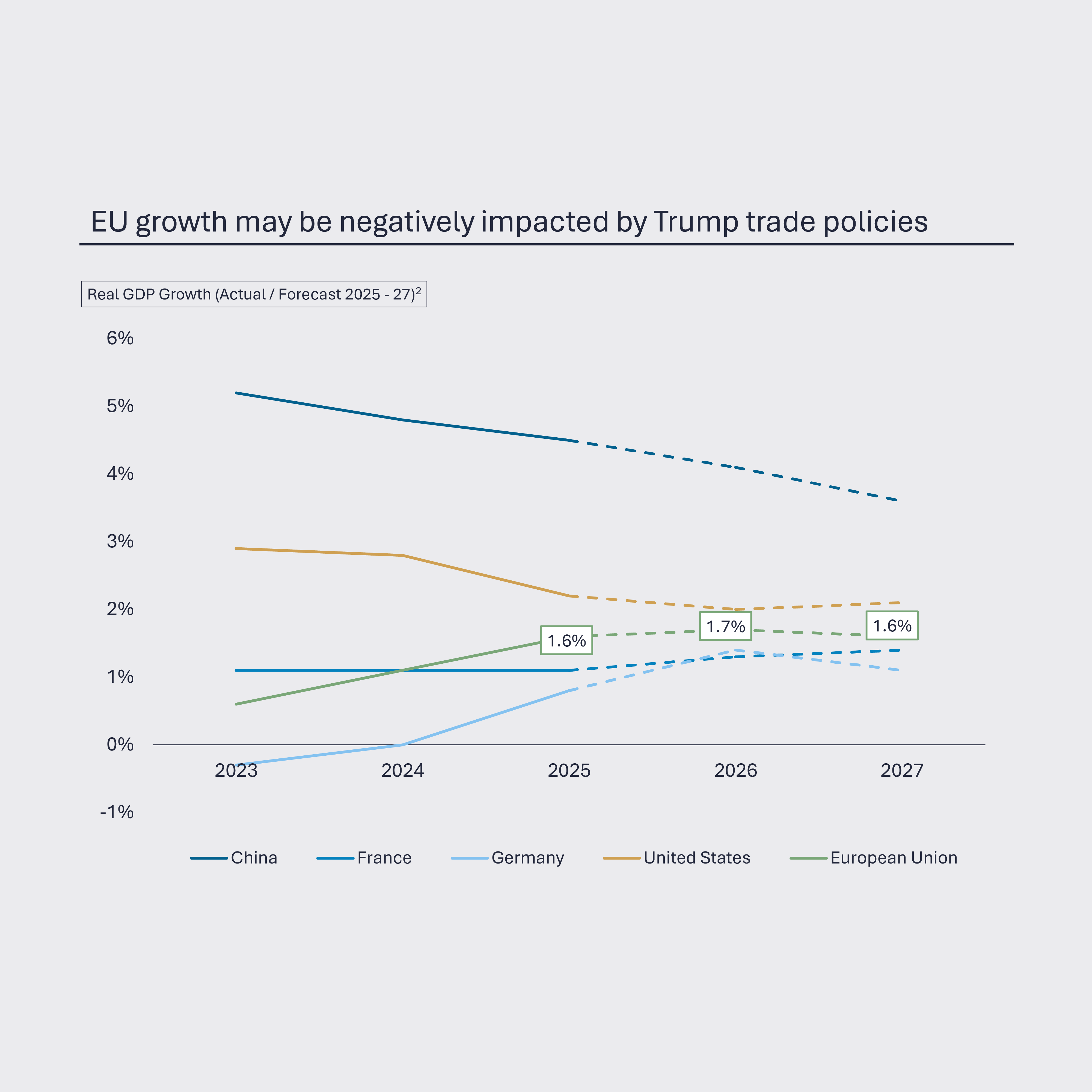

The EU will face pressure from many directions going into 2025. High energy prices and competitive pressures from China and the US are challenging European industry, with growth forecasts between 0.8% and 1.6%. The US trade agenda could worsen these challenges by potentially imposing tariffs on Europe and redirecting cheap Chinese exports to the region. A revised American approach to the Ukraine conflict will also impact European security. At the same time, fiscal constraints like Germany's debt brake limit Europe’s room for maneuver. The EU faces tough choices: conciliating the US with LNG purchases and defense spending may not prevent tariffs, and increasing tariffs against China may not gain support from EU member states like Germany.

2 IMF

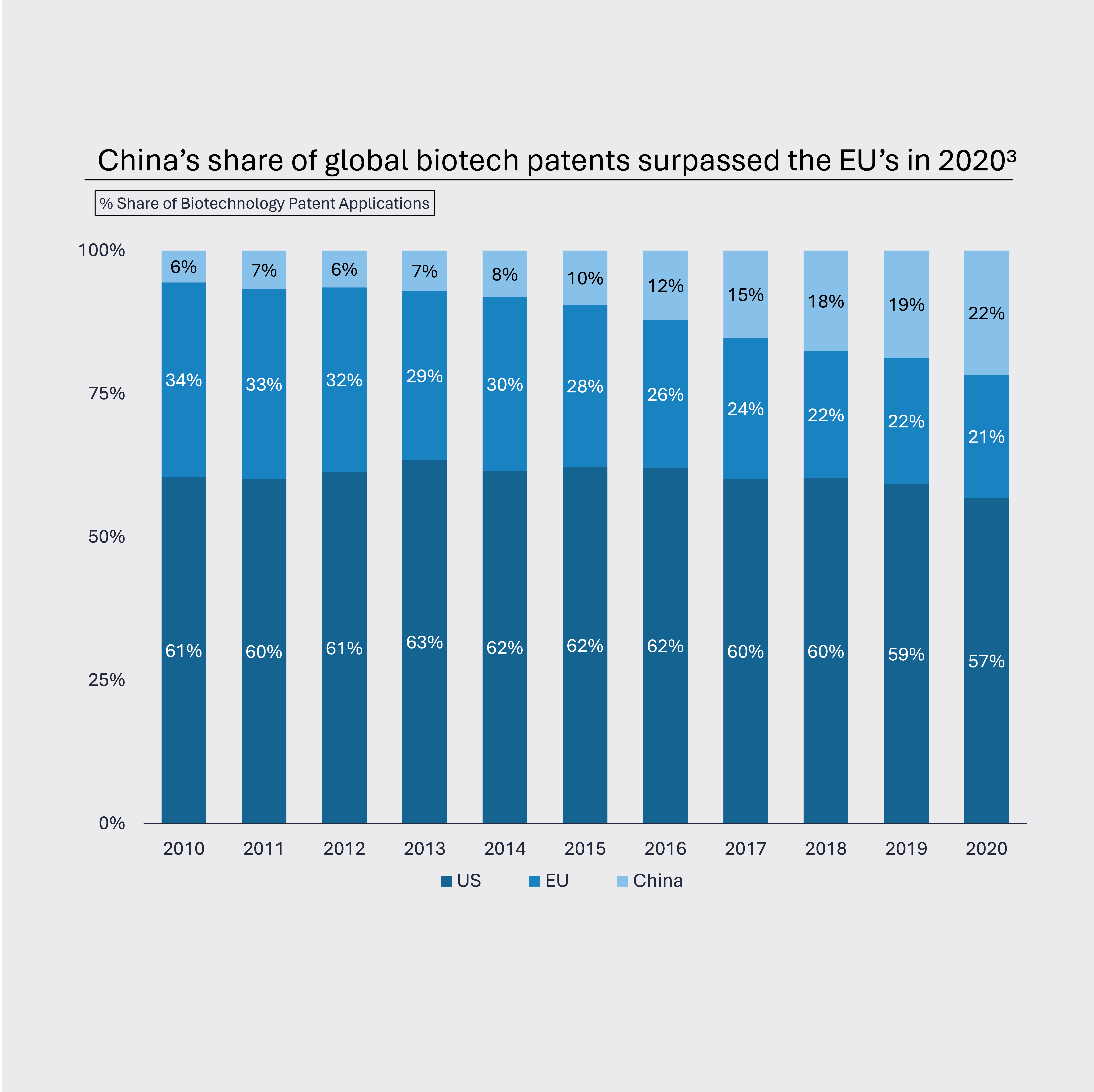

Biotech: A New Geopolitical Frontier

Biotech will grow as a new battleground for geopolitical competition in 2025 as countries recognize its strategic importance to economic growth, national security, and human health. As these dynamics unfold, the global biotech landscape will become more fragmented, requiring companies to be nimble in the construction and movement of their value chains.

3 World Intellectual Property Organization via OECD Data Explorer.